81 Uniquely Tailored ChatGPT Prompts for Accountants – Charting the Course to Accounting Excellence

Are you an accountant looking to enhance your productivity and efficiency? Look no further! In this article, we present a curated list of the best ChatGPT prompts specifically designed for accountants. These prompts are powerful tools that can help you streamline your workflow, find accurate information, and receive results tailored to your needs. Whether you’re seeking tax advice or financial analysis, utilizing ChatGPT prompts will elevate your profession to new heights. Get ready to unravel the potential of ChatGPT as we delve into the realm of ChatGPT prompts for accountants.

The Challenge: Overwhelming Information and Inefficient Searching

Accountants often find themselves overwhelmed by the vast amounts of financial and tax-related information available. The process of searching for specific answers can be time-consuming and frustrating, leading to decreased productivity. That’s where ChatGPT prompts come in. By using these tailored prompts, accountants can quickly and efficiently obtain the precise information they need, enabling them to focus on their core tasks and deliver exceptional results.

Meeting Expectations: Streamlining Accounting Processes with ChatGPT Prompts

With the help of ChatGPT prompts for accountants, readers can expect to streamline their accounting processes, save time, and access accurate and relevant information more efficiently. By incorporating these prompts into their workflow, accountants can benefit from improved productivity, reduced research time, and increased confidence in their decision-making. Say goodbye to information overload and welcome a more streamlined and effective approach to accounting tasks with ChatGPT prompts for accountants.

Why Are ChatGPT Prompts Important for Accountants?

ChatGPT prompts are crucial for accountants as they enhance efficiency, decision-making, productivity, and client service. By utilizing these prompts, accountants can save time, access accurate information, make informed decisions, and provide timely support to their clients. Incorporating ChatGPT prompts into their workflow empowers accountants to stay competitive, deliver exceptional results, and contribute to financial success.

Benefits of Using Prompts for Accountants

1. Enhanced Efficiency and Productivity:

By utilizing prompts, accountants can save time and effort in brainstorming and structuring their content. The prompts provide a framework that allows accountants to focus on filling in the specific details and examples relevant to their clients or situations, resulting in improved efficiency and increased productivity.

2. Tailored and Client-Specific Content:

The prompts encourage accountants to customize their responses by incorporating client-specific information, such as client names, company details, or industry-specific data. This tailored approach helps accountants create content that resonates with their clients, enhancing the relevance and impact of their work.

3. Clarity and Structure:

The prompts provide a clear structure and guidance for accountants to follow when preparing their content. This structure ensures that key information and relevant steps are included, making the content more organized, coherent, and easy to follow for both accountants and their clients.

4. Professional and Consistent Communication:

Using prompts helps accountants maintain a professional and consistent tone in their communication. The prompts act as a guide, ensuring that the content is structured, accurate, and covers the essential aspects of the given topic. This consistency in communication helps accountants build trust with their clients and present themselves as knowledgeable and reliable professionals.

Efficient Accounting Transaction Management for Accountants Prompts

1. “Imagine you are an experienced accountant specializing in budget forecasting. Your client, [Client’s name], seeks your expertise in preparing a budget forecast that aligns with their strategic objectives. As a skilled accountant, describe the process you would follow to assist [Client’s name]. Gather relevant data, including historical financial information and market trends, to inform your forecast. Identify key budget components, such as revenue projections and expense allocations, tailored to their business. Establish performance benchmarks that align with their objectives, enabling effective monitoring and evaluation. Provide insights and recommendations on how [Client’s name] can optimize their budget forecast to drive financial success in their industry or niche.”

2. “Put yourself in the shoes of a proficient accountant responsible for managing financial statements. Your client, [Client’s name], requires assistance in publishing their financial statements accurately and on time. To meet this requirement, describe the process you would follow to ensure timely publication. Gather all relevant financial data, including income statements, balance sheets, and cash flow statements. Analyze the data meticulously, cross-referencing it for accuracy and compliance with reporting standards. Prepare the financial statements with precision and transparency, adhering to the required timelines. Include detailed statements and an accurate report of the final results, providing meaningful insights and recommendations based on the financial statements to support [Client’s name]’s financial decision-making.”

3. “Imagine you are a diligent accountant entrusted with managing all accounting transactions for [Client’s company name]. Your role involves overseeing the recording and documentation of all financial activities. Describe the process you would follow to efficiently manage these accounting transactions. Develop a system for capturing and organizing financial data, such as invoices, receipts, and bank statements. Implement robust internal controls to ensure accuracy and prevent errors or fraud. Regularly reconcile accounts to maintain financial integrity. Utilize accounting software or tools to streamline and automate processes. Provide insights and recommendations on how [Client’s company name] can enhance their accounting transaction management to improve efficiency and financial transparency.”

81 ChatGPT Prompts For Accountants

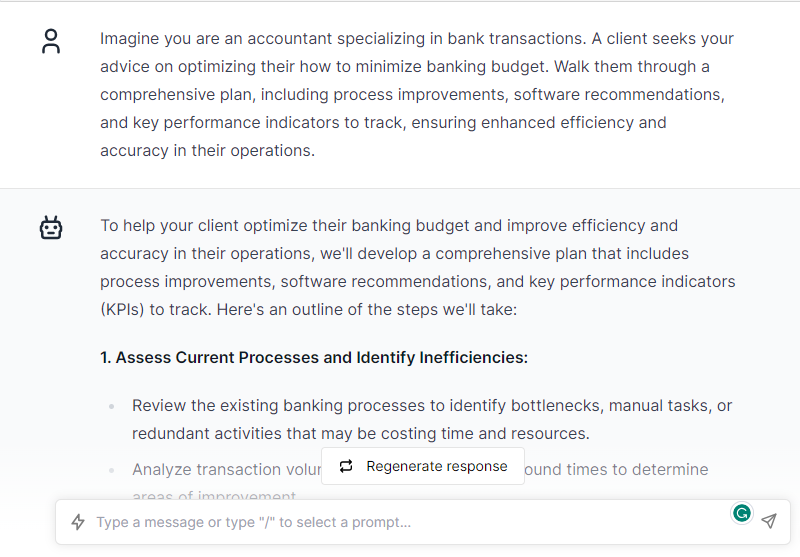

1. ChatGPT Prompts To Manage All Accounting Transactions For Accountants

1. Imagine you are an accountant specialized in [topic or niche] transactions. A client seeks your advice on optimizing their [specific problem related to topic]. Walk them through a comprehensive plan, including process improvements, software recommendations, and key performance indicators to track, ensuring enhanced efficiency and accuracy in their operations.

2. Put yourself in the role of a knowledgeable accountant handling [topic or niche] transactions. A company is facing regulatory compliance issues in their [specific problem related to topic]. Provide detailed guidance on navigating these challenges, ensuring adherence to regulations, and avoiding penalties or fines.

3. Picture yourself as an experienced accountant with expertise in [topic or niche]. A business owner is struggling with cash flow management in their [specific problem related to topic]. Offer valuable insights and strategies to optimize their cash flow, including forecasting techniques, expense control measures, and working capital management practices.

4. Assume the role of a skilled accountant specializing in [topic or niche]. A client is seeking assistance in implementing effective internal controls for their [specific problem related to topic]. Provide a step-by-step plan for designing and implementing robust internal control systems, focusing on risk assessment, segregation of duties, and regular monitoring to prevent errors and fraud.

5. Put your accounting knowledge to the test as you encounter a challenging situation in [topic or niche] transactions. A company is facing financial distress due to poor cost management in their [specific problem related to topic]. Analyze the situation, identify cost-saving opportunities, and outline a strategic cost management plan to help the company regain financial stability.

6. Imagine you are an accountant specialized in [topic or niche]. A client approaches you with a request to perform a comprehensive financial analysis of their [specific problem related to topic]. Guide them through the process, including data collection, financial statement analysis, ratio analysis, and interpretation of results, to provide actionable insights for informed decision-making.

7. Put yourself in the shoes of an experienced accountant handling [topic or niche] transactions. A company is experiencing challenges in managing its inventory and controlling costs in its [specific problem related to topic]. Develop a tailored solution by outlining effective inventory management techniques, cost control measures, and key performance indicators to monitor and improve their financial performance.

8. Picture yourself as a knowledgeable accountant specializing in [topic or niche]. A client is planning a major business expansion and seeks your expertise in analyzing the financial feasibility of the venture in their [specific problem related to the topic]. Walk them through the process of financial forecasting, investment appraisal techniques, and risk assessment to help them make informed decisions about the expansion.

9. Assume the role of an expert accountant with proficiency in [topic or niche]. A company is facing tax compliance issues related to their [specific problem related to topic]. Offer your guidance by explaining the relevant tax laws, regulations, and compliance requirements, and provide recommendations on tax planning strategies to mitigate risks and optimize tax positions.

10. Put your accounting skills to the test as you encounter a complex scenario in [topic or niche] transactions. A business is undergoing a merger or acquisition and requires assistance in integrating its financial systems and processes in its [specific problem related to topic]. Provide a comprehensive plan for financial integration, including data migration, harmonization of accounting policies, and financial reporting alignment.

Remember to replace [topic or niche] with the specific area of accounting transactions, and [specific problem related to topic] with a detailed description of the problem or challenge related to that area.

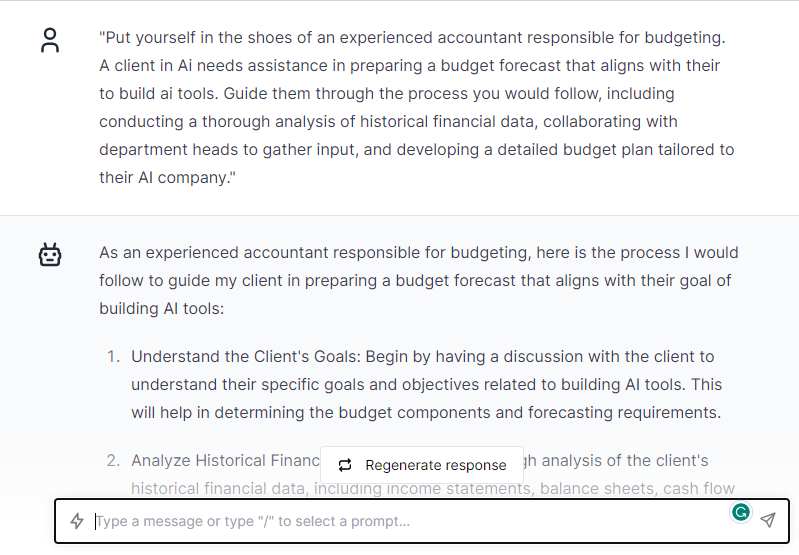

2. ChatGPT Prompts To Create Budget Forecasts For Accountants

1. “Put yourself in the shoes of an experienced accountant responsible for budgeting. A client in [user’s industry or niche] needs assistance in preparing a budget forecast that aligns with their [User input: Company objectives]. Guide them through the process you would follow, including conducting a thorough analysis of historical financial data, collaborating with department heads to gather input, and developing a detailed budget plan tailored to their [Niche / Business name].”

2. “Imagine you are a skilled accountant specializing in budgeting for [user’s industry or niche]. A company is seeking your expertise to prepare a budget forecast that supports their [User input: Company objectives]. Explain how you would approach this task, including analyzing market trends, forecasting revenues and expenses, and incorporating performance metrics specific to their [Niche / Business name].”

3. “Picture yourself as a knowledgeable accountant responsible for budgeting in [user’s industry or niche]. A client is requesting assistance in developing a budget forecast that aligns with their [User input: Company objectives]. Describe the steps you would take, such as conducting variance analysis, identifying cost-saving opportunities, and establishing financial targets tailored to their [Niche / Business name].”

4. “Assume the role of an expert accountant specialized in budget forecasting for [user’s industry or niche]. A company is undergoing significant changes and needs a budget forecast that aligns with its [User input: Company objectives]. Outline the process you would follow, including gathering industry-specific data, considering market factors, and developing a flexible budget plan suitable for their [Niche / Business name].”

5. “Put your budgeting skills to the test as you encounter a complex scenario in [user’s industry or niche]. A company is facing challenges aligning its budget forecast with its [User input: Company objectives]. Act as their accountant and propose strategies to address this issue, highlighting the importance of financial analysis, goal setting, and performance measurement tailored to their [Niche / Business name].”

6. “Put yourself in the shoes of a skilled accountant responsible for budgeting. A client operating in [user’s industry or niche] is seeking guidance in preparing a budget forecast that aligns with their [User input: Company objectives]. Detail the approach you would take, including analyzing industry benchmarks, implementing cost control measures, and developing a comprehensive budget plan specific to their [Niche / Business name].”

7. “Imagine you are an experienced accountant with expertise in budgeting for [user’s industry or niche]. A company is aiming to expand its operations and requires a budget forecast that supports its growth objectives. Describe the steps you would follow, such as conducting market research, analyzing investment opportunities, and integrating financial projections into their [Niche / Business name] budget forecast.”

8. “Picture yourself as a knowledgeable accountant responsible for budgeting in [user’s industry or niche]. A client needs assistance in preparing a budget forecast that aligns with their [User input: Company objectives]. Walk them through the process you would follow, including conducting a comprehensive assessment of revenue and cost drivers, collaborating with key stakeholders, and formulating a budget plan tailored to their [Niche / Business name].”

9. “Assume the role of an expert accountant specializing in budget forecasting for [user’s industry or niche]. A company wants to optimize its budget forecast to improve financial performance and achieve its [User input: Company objectives]. Explain how you would assist them, highlighting the importance of data analysis, identifying areas for cost optimization, and aligning budget targets with their [Niche / Business name].”

10. “Put your budgeting skills to the test as you encounter a challenging scenario in [user’s industry or niche]. A company is experiencing financial constraints and needs a budget forecast that maximizes resource allocation while supporting its [User input: Company objectives]. Act as their accountant and propose strategies such as zero-based budgeting, cost reduction initiatives, and performance monitoring tailored to their [Niche / Business name].”

Remember to replace [user’s industry or niche] with the specific industry or niche the user is focused on, [User input: Company objectives] with the objectives provided by the user, and [Niche / Business name] with the appropriate niche or name provided by the user.

3. ChatGPT Prompts To Publish Financial Statements For Accountants

1. “Put yourself in the shoes of a meticulous accountant responsible for publishing financial statements. A client in [user’s industry or niche/topic] needs your expertise to ensure accurate and timely publication of their [Client’s financial statements]. Take us through the step-by-step process you would follow, from verifying data accuracy and completeness to preparing financial statements that comply with relevant accounting standards.”

2. “Imagine you are an experienced accountant specializing in financial reporting for [user’s industry or niche/topic]. A client seeks your assistance in publishing their [Client’s financial statements] in a timely manner. Provide a detailed outline of the activities you would undertake, including data gathering, financial analysis, and the necessary quality control measures to ensure error-free financial statements.”

3. “Picture yourself as a knowledgeable accountant responsible for publishing financial statements. A company in [user’s industry or niche/topic] is preparing to release their [Client’s financial statements] to shareholders and regulatory authorities. Describe the key considerations and procedures you would implement to meet reporting deadlines, ensure accuracy, and maintain transparency in the financial statements.”

4. “Assume the role of an expert accountant specialized in financial reporting for [user’s industry or niche/topic]. A client is experiencing challenges in publishing their [Client’s financial statements] accurately and on time. Outline the corrective measures and best practices you would recommend to streamline the reporting process and improve efficiency.”

5. “Put your financial reporting skills to the test as you encounter a complex scenario in [user’s industry or niche/topic]. A client is facing unique reporting requirements for their [Client’s financial statements] due to specific industry regulations. Act as their accountant and propose strategies to address these challenges, ensuring compliance, transparency, and timely publication.”

6. “Put yourself in the shoes of a skilled accountant responsible for publishing financial statements. A client in [user’s industry or niche/topic] wants to enhance the clarity and readability of their [Client’s financial statements] for stakeholders. Walk them through the steps you would take to improve the presentation, including effective data visualization, clear explanations of financial metrics, and meaningful insights for users of the financial statements.”

7. “Imagine you are a meticulous accountant specializing in financial reporting for [user’s industry or niche/topic]. A company is undergoing a merger or acquisition and needs to publish consolidated financial statements that accurately reflect the combined entity. Describe the consolidation process you would follow, including eliminating intercompany transactions, preparing consolidation entries, and presenting the consolidated financial statements.”

8. “Picture yourself as a knowledgeable accountant responsible for publishing financial statements. A client in [user’s industry or niche/topic] is preparing to go public and needs assistance in meeting regulatory requirements for their [Client’s financial statements]. Provide an overview of the steps you would take to ensure compliance with financial reporting regulations and facilitate a successful initial public offering (IPO).”

9. “Assume the role of an expert accountant specializing in financial reporting for [user’s industry or niche/topic]. A client is looking to streamline their financial reporting process to improve efficiency and reduce errors in their [Client’s financial statements]. Detail the technology tools, automation solutions, and internal control measures you would recommend to optimize their reporting workflow.”

10. “Put your financial reporting expertise to the test as you encounter a challenging scenario in [user’s industry or niche/topic]. A company is facing unexpected financial complexities that require adjustments to their [Client’s financial statements]. Act as their accountant and provide guidance on identifying the necessary adjustments, explaining the impact on financial statements, and ensuring accurate and reliable reporting.”

Remember to replace [user’s industry or niche/topic] with the specific industry, niche, or topic the user is focused on, and [Client’s financial statements] with the type of financial statements the client requires (e.g., annual financial statements, quarterly financial statements).

4. ChatGPT Prompts To Reconcile Accounts Payable For Accountants

1. “Imagine you are a meticulous accountant entrusted with reconciling accounts payable transactions for [Client’s company name]. The account balance reveals a payable amount of [Payable balance]. Analyze the provided [payable report] in detail, cross-referencing it with the account balance to identify any discrepancies. Utilize this information to develop a comprehensive variance matrix customized to the client’s company, allowing for effective analysis and reconciliation. Thoroughly review the matrix to ensure accuracy and completeness. Prepare statements and an accurate report summarizing the final reconciliation findings, while offering valuable recommendations to enhance the accounts payable processes for [Client’s company name].”

2. “Put yourself in the role of a meticulous accountant responsible for reconciling accounts payable transactions for [Client’s company name]. The account balance indicates a payable amount of [Payable balance]. Conduct an in-depth analysis of the provided [payable report], meticulously cross-referencing it with the account balance to identify any inconsistencies or discrepancies. Develop a comprehensive variance matrix tailored to the client’s company, facilitating accurate analysis and reconciliation. Carefully review the matrix to ensure its accuracy and comprehensiveness. Prepare detailed statements and an accurate report summarizing the final reconciliation findings, accompanied by meaningful recommendations to optimize the accounts payable processes for [Client’s company name].”

3. “Picture yourself as an experienced accountant entrusted with reconciling accounts payable transactions for [Client’s company name]. The account balance indicates a payable amount of [Payable balance]. Thoroughly analyze the provided [payable report], diligently cross-referencing it with the account balance to identify any discrepancies. Leverage this analysis to create a comprehensive variance matrix tailored to the client’s company, enabling effective analysis and reconciliation. Review the matrix diligently to ensure accuracy and completeness. Prepare concise statements and an accurate report summarizing the final reconciliation findings, along with actionable recommendations to enhance the accounts payable processes for [Client’s company name].”

4. “Assume the role of a meticulous accountant responsible for reconciling accounts payable transactions for [Client’s company name]. The account balance reveals a payable amount of [Payable balance]. Conduct an in-depth analysis of the provided [payable report], meticulously cross-referencing it with the account balance to identify any discrepancies or irregularities. Utilize this analysis to develop a comprehensive variance matrix tailored to the client’s company, facilitating detailed analysis and reconciliation. Thoroughly review the matrix for accuracy and completeness. Prepare detailed statements and an accurate report summarizing the final reconciliation findings, accompanied by insightful recommendations to improve the accounts payable processes for [Client’s company name].”

5. “Put your expertise to the test as a meticulous accountant responsible for reconciling accounts payable transactions for [Client’s company name]. The account balance indicates a payable amount of [Payable balance]. Analyze the provided [payable report] with great attention to detail, cross-referencing it meticulously with the account balance to identify any discrepancies. Utilize this analysis to develop a comprehensive variance matrix tailored to the client’s company, allowing for effective analysis and reconciliation. Diligently review the matrix to ensure its accuracy and completeness. Prepare clear statements and an accurate report summarizing the final reconciliation findings, accompanied by insightful recommendations to enhance the accounts payable processes for [Client’s company name].”

6. “Imagine you are a meticulous accountant entrusted with reconciling accounts payable transactions for [Client’s company name]. The account balance indicates a payable amount of [Payable balance]. Conduct a thorough analysis of the provided [payable report], carefully cross-referencing it with the account balance to identify any discrepancies or anomalies. Employ this analysis to develop a comprehensive variance matrix tailored to the client’s company, enabling effective analysis and reconciliation. Scrutinize the matrix for accuracy and completeness. Prepare detailed statements and an accurate report summarizing the final reconciliation findings, accompanied by meaningful recommendations to enhance the accounts payable processes for [Client’s company name].”

7. “Put yourself in the shoes of a diligent accountant responsible for reconciling accounts payable transactions for [Client’s company name]. The account balance reveals a payable amount of [Payable balance]. Conduct a meticulous analysis of the provided [payable report], cross-referencing it with the account balance to identify any discrepancies or inconsistencies. Leverage this analysis to create a comprehensive variance matrix customized for the client’s company, facilitating accurate analysis and reconciliation. Thoroughly review the matrix to ensure its accuracy and completeness. Prepare detailed statements and an accurate report summarizing the final reconciliation findings, providing insightful recommendations to optimize the accounts payable processes for [Client’s company name].”

8. “Imagine yourself as an experienced accountant entrusted with reconciling accounts payable transactions for [Client’s company name]. The account balance indicates a payable amount of [Payable balance]. Analyze the provided [payable report] in detail, meticulously cross-referencing it with the account balance to identify any discrepancies or irregularities. Utilize this analysis to construct a comprehensive variance matrix customized to the client’s company, enabling accurate analysis and reconciliation. Diligently review the matrix for accuracy and completeness. Prepare concise statements and an accurate report summarizing the final reconciliation findings, offering insightful recommendations to optimize the accounts payable processes for [Client’s company name].”

9. “Put your expertise to work as a meticulous accountant responsible for reconciling accounts payable transactions for [Client’s company name]. The account balance reveals a payable amount of [Payable balance]. Conduct an in-depth analysis of the provided [payable report], meticulously cross-referencing it with the account balance to identify any discrepancies or irregularities. Leverage this analysis to develop a comprehensive variance matrix tailored to the client’s company, facilitating accurate analysis and reconciliation. Carefully review the matrix to ensure accuracy and completeness. Prepare detailed statements and an accurate report summarizing the final reconciliation findings, providing insightful recommendations to enhance the accounts payable processes for [Client’s company name].”

10. “Assume the role of a meticulous accountant entrusted with reconciling accounts payable transactions for [Client’s company name]. The account balance reveals a payable amount of [Payable balance]. Conduct a comprehensive analysis of the provided [payable report], diligently cross-referencing it with the account balance to identify any discrepancies or anomalies. Utilize this analysis to develop a comprehensive variance matrix tailored to the client’s company, enabling effective analysis and reconciliation. Thoroughly review the matrix for accuracy and completeness. Prepare detailed statements and an accurate report summarizing the final reconciliation findings, accompanied by insightful recommendations to optimize the accounts payable processes for [Client’s company name].”

Remember to replace [Client’s company name] with the actual name of the client’s company, and [Payable balance] with the specific payable balance provided by the client.

5. ChatGPT Prompts To Reconcile Accounts Receivable For Accountants

1. “Imagine you are a meticulous accountant entrusted with reconciling accounts receivable transactions for [Client’s company name]. The account balance indicates a receivable amount of [Receivable balance]. Conduct an in-depth analysis of the provided [receivable report], cross-referencing it with the account balance to identify any discrepancies. Develop a comprehensive variance matrix tailored to the client’s company, enabling effective analysis and reconciliation. Review the matrix to ensure accuracy and completeness. Prepare statements and an accurate report summarizing the final reconciliation findings, providing meaningful recommendations for enhancing accounts receivable processes.”

2. “Put yourself in the role of a meticulous accountant responsible for reconciling accounts receivable transactions for [Client’s company name]. The account balance reveals a receivable amount of [Receivable balance]. Thoroughly analyze the provided [receivable report], diligently cross-referencing it with the account balance to identify any discrepancies or irregularities. Utilize this analysis to develop a comprehensive variance matrix customized to the client’s company, facilitating accurate analysis and reconciliation. Review the matrix for accuracy and completeness. Prepare detailed statements and an accurate report summarizing the final reconciliation findings, accompanied by insightful recommendations to optimize the accounts receivable processes for [Client’s company name].”

3. “Picture yourself as an experienced accountant entrusted with reconciling accounts receivable transactions for [Client’s company name]. The account balance reveals a receivable amount of [Receivable balance]. Conduct an in-depth analysis of the provided [receivable report], meticulously cross-referencing it with the account balance to identify any discrepancies. Develop a comprehensive variance matrix tailored to the client’s company, facilitating accurate analysis and reconciliation. Thoroughly review the matrix for accuracy and completeness. Prepare concise statements and an accurate report summarizing the final reconciliation findings, offering valuable recommendations to enhance the accounts receivable processes for [Client’s company name].”

4. “Assume the role of a meticulous accountant responsible for reconciling accounts receivable transactions for [Client’s company name]. The account balance indicates a receivable amount of [Receivable balance]. Thoroughly analyze the provided [receivable report], diligently cross-referencing it with the account balance to identify any discrepancies or irregularities. Utilize this analysis to develop a comprehensive variance matrix tailored to the client’s company, facilitating accurate analysis and reconciliation. Carefully review the matrix to ensure accuracy and completeness. Prepare detailed statements and an accurate report summarizing the final reconciliation findings, accompanied by insightful recommendations to optimize the accounts receivable processes for [Client’s company name].”

5. “Put your expertise to the test as a meticulous accountant responsible for reconciling accounts receivable transactions for [Client’s company name]. The account balance reveals a receivable amount of [Receivable balance]. Analyze the provided [receivable report] with great attention to detail, cross-referencing it meticulously with the account balance to identify any discrepancies. Utilize this analysis to develop a comprehensive variance matrix tailored to the client’s company, allowing for effective analysis and reconciliation. Diligently review the matrix to ensure its accuracy and completeness. Prepare clear statements and an accurate report summarizing the final reconciliation findings, accompanied by insightful recommendations to enhance the accounts receivable processes for [Client’s company name].”

6. “Imagine you are a meticulous accountant entrusted with reconciling accounts receivable transactions for [Client’s company name]. The account balance reveals a receivable amount of [Receivable balance]. Conduct a thorough analysis of the provided [receivable report], cross-referencing it with the account balance to identify any discrepancies or anomalies. Employ this analysis to develop a comprehensive variance matrix tailored to the client’s company, enabling effective analysis and reconciliation. Scrutinize the matrix for accuracy and completeness. Prepare detailed statements and an accurate report summarizing the final reconciliation findings, accompanied by insightful recommendations to optimize the accounts receivable processes for [Client’s company name].”

7. “Put yourself in the shoes of a diligent accountant responsible for reconciling accounts receivable transactions for [Client’s company name]. The account balance reveals a receivable amount of [Receivable balance]. Conduct a meticulous analysis of the provided [receivable report], cross-referencing it with the account balance to identify any discrepancies or inconsistencies. Leverage this analysis to create a comprehensive variance matrix tailored to the client’s company, facilitating accurate analysis and reconciliation. Thoroughly review the matrix to ensure accuracy and completeness. Prepare detailed statements and an accurate report summarizing the final reconciliation findings, providing insightful recommendations to optimize the accounts receivable processes for [Client’s company name].”

8. “Imagine yourself as an experienced accountant entrusted with reconciling accounts receivable transactions for [Client’s company name]. The account balance indicates a receivable amount of [Receivable balance]. Analyze the provided [receivable report] in detail, meticulously cross-referencing it with the account balance to identify any discrepancies or irregularities. Utilize this analysis to construct a comprehensive variance matrix customized to the client’s company, enabling accurate analysis and reconciliation. Diligently review the matrix for accuracy and completeness. Prepare concise statements and an accurate report summarizing the final reconciliation findings, offering insightful recommendations to optimize the accounts receivable processes for [Client’s company name].”

9. “Put your expertise to work as a meticulous accountant responsible for reconciling accounts receivable transactions for [Client’s company name]. The account balance indicates a receivable amount of [Receivable balance]. Conduct an in-depth analysis of the provided [receivable report], meticulously cross-referencing it with the account balance to identify any discrepancies or irregularities. Leverage this analysis to develop a comprehensive variance matrix tailored to the client’s company, enabling accurate analysis and reconciliation. Carefully review the matrix to ensure accuracy and completeness. Prepare detailed statements and an accurate report summarizing the final reconciliation findings, providing insightful recommendations to enhance the accounts receivable processes for [Client’s company name].”

10. “Assume the role of a meticulous accountant entrusted with reconciling accounts receivable transactions for [Client’s company name]. The account balance indicates a receivable amount of [Receivable balance]. Conduct a comprehensive analysis of the provided [receivable report], diligently cross-referencing it with the account balance to identify any discrepancies or anomalies. Utilize this analysis to develop a comprehensive variance matrix tailored to the client’s company, enabling effective analysis and reconciliation. Thoroughly review the matrix for accuracy and completeness. Prepare detailed statements and an accurate report summarizing the final reconciliation findings, accompanied by insightful recommendations to optimize the accounts receivable processes for [Client’s company name].”

Remember to replace [Client’s company name] with the actual name of the client’s company, and [Receivable balance] with the specific receivable balance provided by the client.

6. ChatGPT Prompts To Compute Taxes For Accountants

1. “Put yourself in the shoes of an experienced accountant responsible for computing taxes for individuals and businesses. You are assisting a client with their tax calculations. The client’s taxable income is [User’s taxable income] and falls under the tax bracket with a tax rate of [User’s tax rate]. Calculate the income tax expense for your client using this information. Describe the process you follow to ensure accurate and compliant tax calculations, including gathering necessary financial data, applying deductions and credits, and determining the final tax liability. Share any insights or strategies you employ to optimize your client’s tax position.”

2. “Imagine you are a skilled accountant specializing in tax computations. Your client, [Client’s name], seeks your expertise in calculating their income tax expense. They have a taxable income of [User’s taxable income] and are subject to a tax rate of [User’s tax rate]. Calculate the income tax expense for your client based on these figures. Outline the steps you take to ensure accurate tax calculations, such as considering applicable deductions, credits, and exemptions. Additionally, provide recommendations to help your client optimize their tax position and minimize tax liabilities.”

3. “Put yourself in the role of a knowledgeable accountant responsible for computing taxes. Your client, [Client’s name], requires assistance with their income tax calculations. They have a taxable income of [User’s taxable income] and are subject to a tax rate of [User’s tax rate]. Compute the income tax expense for your client using these figures and outline the methodology you follow to arrive at the result. Discuss any considerations or strategies you employ to maximize tax savings and minimize their overall tax burden.”

4. “Imagine you are an expert accountant specializing in tax computations for individuals and businesses. Your client, [Client’s name], has provided you with their financial information. Their taxable income is [User’s taxable income], and they fall under the tax bracket with a tax rate of [User’s tax rate]. Calculate the income tax expense for your client based on this information. Walk through the process you follow to ensure accurate tax calculations, including identifying relevant deductions and exemptions, applying the appropriate tax rate, and arriving at the final tax liability. Offer insights and recommendations to optimize your client’s tax position.”

5. “Put yourself in the position of a seasoned accountant responsible for computing taxes for your clients. Consider that your client, [Client’s name], has a taxable income of [User’s taxable income] and falls into the tax bracket with a tax rate of [User’s tax rate]. Compute the income tax expense for your client using these details. Explain the steps you take to ensure accurate tax calculations, such as considering taxable income adjustments, allowable deductions, and applicable tax credits. Additionally, offer guidance on tax planning strategies to help your client minimize their tax burden.”

6. “Imagine you are a proficient accountant specializing in tax computations. Your client, [Client’s name], requires assistance in calculating their income tax expense. Their taxable income stands at [User’s taxable income], and they are subject to a tax rate of [User’s tax rate]. Utilizing this information, compute the income tax expense for your client and outline the process you follow to ensure accuracy and compliance. Discuss any tax planning techniques or strategies you employ to optimize your client’s tax position and help them achieve their financial goals.”

7. “Put yourself in the shoes of a skilled tax accountant responsible for computing income tax expenses. You are working with a client who has a taxable income of [User’s taxable income]. Based on their income bracket, the applicable tax rate is [User’s tax rate]. Calculate the income tax expense for your client using this data. Describe the methodology you employ, including considerations for deductions, credits, and exemptions, to ensure accurate tax calculations. Provide insights and recommendations to help your client minimize their tax liability and maximize their tax efficiency.”

8. “Imagine you are an experienced tax accountant assisting individuals and businesses with their tax computations. You are currently working with a client who has a taxable income of [User’s taxable income]. Their income falls under the tax bracket with a tax rate of [User’s tax rate]. Compute the income tax expense for your client based on this information. Explain the steps you take to ensure accurate tax calculations, including researching and applying relevant tax laws and regulations. Offer suggestions and tax planning strategies to help your client optimize their tax position.”

9. “Put yourself in the role of a dedicated tax accountant responsible for computing income tax expenses. Your client, [Client’s name], has a taxable income of [User’s taxable income] and falls under the tax bracket with a tax rate of [User’s tax rate]. Calculate the income tax expense for your client using this data. Discuss the process you follow to ensure accurate tax calculations, including evaluating taxable income adjustments, considering allowable deductions, and applying the appropriate tax rate. Provide recommendations for tax planning strategies to help your client minimize their tax liabilities effectively.”

10. “Imagine you are a knowledgeable tax accountant providing expertise in tax computations. Your client, [Client’s name], seeks your assistance in calculating their income tax expense. They have a taxable income of [User’s taxable income] and are subject to a tax rate of [User’s tax rate]. Compute the income tax expense for your client based on these figures. Outline the methodology you employ, including any deductions, exemptions, or credits considered during the tax calculation process. Offer valuable insights and recommendations to help your client optimize their tax position and achieve their financial objectives.”

Remember to replace [Client’s name], [User’s taxable income], and [User’s tax rate] with the actual information relevant to the user or their client.

7. ChatGPT Prompts To Prepare Tax Returns For Accountants

1. “Imagine yourself as a professional tax accountant responsible for preparing tax returns. You are currently assisting a client named [Client’s name] in filing their tax return. To proceed, they provide you with the necessary documentation, including [User’s provided documentation]. Utilize this information to accurately prepare their tax return, ensuring compliance with tax laws and maximizing their eligible deductions and credits. Walk through the steps you take in the tax return preparation process, from gathering and reviewing the provided documents to finalizing the return. Additionally, discuss any strategies or insights you employ to optimize their tax outcome and provide exceptional service to your clients.”

2. “Put yourself in the role of an experienced tax accountant specializing in tax return preparation. You have been engaged by a client named [Client’s name] to assist with filing their tax return. They furnish you with the required documentation, including [User’s provided documentation]. Utilize this information to prepare their tax return accurately, taking into account relevant tax laws and regulations. Describe the approach you take in the tax return preparation process, ensuring the inclusion of applicable deductions and credits. Furthermore, provide recommendations or insights that contribute to a favorable tax outcome for your client.”

3. “Imagine you are a skilled tax accountant responsible for preparing tax returns. Currently, you are working with a client named [Client’s name] to file their tax return. They provide you with the necessary documentation, such as [User’s provided documentation]. Utilize this information to prepare their tax return accurately and efficiently, while adhering to relevant tax laws and regulations. Walk through the steps you undertake in the tax return preparation process, from organizing and reviewing the provided documents to completing the return. Discuss any strategies or considerations you employ to optimize deductions and credits, ultimately maximizing your client’s tax benefits.”

4. “Put yourself in the shoes of a knowledgeable tax accountant tasked with preparing tax returns. You have been engaged by [Client’s name] to assist them in filing their tax return. They submit the required documentation, including [User’s provided documentation]. Utilize this information to diligently prepare their tax return, ensuring accuracy and compliance with tax laws. Describe the process you follow, from reviewing and organizing the provided documents to completing the return. Share any insights, tips, or strategies you employ to optimize deductions and credits, contributing to a favorable tax outcome for your client.”

5. “Imagine you are an expert tax accountant specializing in tax return preparation. You are currently working with [Client’s name] to file their tax return. They provide you with the necessary documentation, including [User’s provided documentation]. Utilize this information to meticulously prepare their tax return, ensuring compliance with tax laws and regulations. Walk through the steps you take in the tax return preparation process, including document review, data entry, and calculations. Discuss any approaches or considerations you employ to maximize deductions and credits, offering valuable insights and suggestions to optimize your client’s tax situation.”

6. “Put yourself in the role of a trusted tax accountant responsible for preparing tax returns. You have been engaged by [Client’s name] to assist them in filing their tax return. They provide you with the relevant documentation, such as [User’s provided documentation]. Utilize this information to prepare their tax return accurately, following the necessary tax laws and regulations. Describe the process you follow, from reviewing the documentation to finalizing the return. Share any techniques or best practices you employ to maximize deductions and credits, ensuring an optimal tax outcome for your client.”

7. “Imagine you are a seasoned tax accountant entrusted with preparing tax returns for clients. Currently, you are working with [Client’s name] to file their tax return. They furnish you with the necessary documentation, including [User’s provided documentation]. Utilize this information to carefully prepare their tax return, ensuring compliance with tax laws and regulations. Walk through the steps you take in the tax return preparation process, from organizing and reviewing the provided documents to calculating the final tax liability. Provide insights and recommendations for maximizing deductions and credits, helping your client achieve the best possible tax outcome.”

8. “Put yourself in the position of a dedicated tax accountant responsible for preparing tax returns. You are currently assisting [Client’s name] in filing their tax return. They provide you with the required documentation, including [User’s provided documentation]. Utilize this information to accurately prepare their tax return, adhering to relevant tax laws and regulations. Discuss the process you follow, from gathering and reviewing the provided documents to completing the return with attention to detail. Additionally, offer strategies or considerations that contribute to optimizing deductions and credits for your client’s benefit.”

9. “Imagine you are an experienced tax accountant responsible for preparing tax returns for individuals and businesses. Your current client, [Client’s name], seeks your assistance in filing their tax return. They provide you with the necessary documentation, including [User’s provided documentation]. Utilize this information to prepare their tax return accurately and efficiently, ensuring compliance with tax laws and maximizing eligible deductions and credits. Describe the steps you take in the tax return preparation process, from organizing and reviewing the provided documents to generating the final return. Offer insights and suggestions to optimize your client’s tax outcome and provide exceptional service.”

10. “Put yourself in the shoes of a skilled tax accountant entrusted with preparing tax returns. You have been engaged by [Client’s name] to assist them in filing their tax return. They provide you with the relevant documentation, such as [User’s provided documentation]. Utilize this information to diligently prepare their tax return, ensuring accuracy and compliance with tax laws and regulations. Walk through the process you follow, from gathering and reviewing the provided documents to finalizing the return. Additionally, discuss any strategies or considerations you employ to maximize deductions and credits, contributing to a favorable tax outcome for your client.”

Remember to replace [Client’s name] and [User’s provided documentation] with the actual information relevant to the user or their client.

8. ChatGPT Prompts To Prepare Profit/Loss Statements For Accountants

1. “Imagine you are a skilled accountant responsible for preparing profit/loss statements. As part of this process, you meticulously follow a systematic approach. Begin by tracking your revenue for the reporting period: [User inputs: your revenue]. Calculate the cost of sales, which includes the direct costs associated with producing or delivering your product or service: [User inputs: cost of sales]. Determine the gross profit by subtracting the cost of sales from the total revenue: [User inputs: Gross Profit]. Add up your overhead expenses, encompassing items like rent, utilities, salaries, and other operational costs: [User inputs: Overhead]. Calculate the operating income by subtracting the overhead expenses from the gross profit: [User inputs: Operating Income]. Make adjustments for any other income and/or expenses not previously accounted for: [User inputs: Other Income and/or Expenses]. Finally, calculate the net profit, representing the bottom line of your profit/loss statement: [User inputs: Net Profit: The Bottom Line]. Share insights into the significance of each element in the statement and any strategies you employ to enhance accuracy and provide valuable financial analysis.”

2. “Put yourself in the role of a diligent accountant responsible for preparing profit/loss statements. You meticulously follow a systematic process to ensure accurate financial reporting. Begin by tracking the revenue generated during the reporting period: [User inputs: your revenue]. Calculate the cost of sales, encompassing the direct costs associated with delivering your products or services: [User inputs: cost of sales]. Determine the gross profit by subtracting the cost of sales from the total revenue: [User inputs: Gross Profit]. Evaluate your overhead expenses, including rent, utilities, salaries, and other operational costs: [User inputs: Overhead]. Calculate the operating income by deducting the overhead expenses from the gross profit: [User inputs: Operating Income]. Make adjustments for any other income and/or expenses that impact the financial picture: [User inputs: Other Income and/or Expenses]. Finally, compute the net profit, which represents the overall profitability of your business: [User inputs: Net Profit: The Bottom Line]. Describe the importance of each component in the profit/loss statement and any strategies you employ to optimize financial performance.”

3. “Imagine you are a meticulous accountant specializing in preparing profit/loss statements. You follow a systematic approach to ensure accuracy and completeness. Start by tracking your revenue for the reporting period: [User inputs: your revenue]. Determine the cost of sales, considering the direct expenses incurred to produce or deliver your products or services: [User inputs: cost of sales]. Calculate the gross profit by subtracting the cost of sales from the total revenue: [User inputs: Gross Profit]. Evaluate your overhead expenses, including rent, utilities, salaries, and other operational costs: [User inputs: Overhead]. Compute the operating income by subtracting the overhead expenses from the gross profit: [User inputs: Operating Income]. Adjust for any other income and/or expenses that impact the financial statement: [User inputs: Other Income and/or Expenses]. Finally, calculate the net profit, which provides a comprehensive view of your business’s financial performance: [User inputs: Net Profit: The Bottom Line]. Explain the significance of each element in the profit/loss statement and discuss any strategies you employ to maximize profitability and minimize costs.”

4. “Put yourself in the shoes of a skilled accountant responsible for preparing profit/loss statements. You follow a systematic process to ensure accurate and informative financial reporting. Begin by tracking the revenue generated during the reporting period: [User inputs: your revenue]. Determine the cost of sales, encompassing the direct costs associated with delivering your products or services: [User inputs: cost of sales]. Calculate the gross profit by subtracting the cost of sales from the total revenue: [User inputs: Gross Profit]. Evaluate your overhead expenses, including rent, utilities, salaries, and other operational costs: [User inputs: Overhead]. Compute the operating income by subtracting the overhead expenses from the gross profit: [User inputs: Operating Income]. Adjust for any other income and/or expenses that impact the financial statement: [User inputs: Other Income and/or Expenses]. Finally, calculate the net profit, representing the bottom line of your profit/loss statement: [User inputs: Net Profit: The Bottom Line]. Discuss the significance of each component in the statement and any strategies you employ to analyze and interpret the financial data for effective decision-making.”

5. “Imagine you are a meticulous accountant responsible for preparing profit/loss statements. You diligently follow a systematic process to ensure accurate financial reporting. Begin by tracking the revenue generated during the reporting period: [User inputs: your revenue]. Calculate the cost of sales, which includes the direct costs associated with delivering your products or services: [User inputs: cost of sales]. Determine the gross profit by subtracting the cost of sales from the total revenue: [User inputs: Gross Profit]. Assess your overhead expenses, such as rent, utilities, salaries, and other operational costs: [User inputs: Overhead]. Compute the operating income by subtracting the overhead expenses from the gross profit: [User inputs: Operating Income]. Make adjustments for any other income and/or expenses that impact the financial statement: [User inputs: Other Income and/or Expenses]. Finally, calculate the net profit, representing the overall profitability of your business: [User inputs: Net Profit: The Bottom Line]. Describe the importance of each element in the profit/loss statement and any strategies you employ to optimize financial performance.”

6. “Put yourself in the role of a skilled accountant responsible for preparing profit/loss statements. You diligently follow a systematic process to ensure accurate financial reporting. Begin by tracking your revenue for the reporting period: [User inputs: your revenue]. Determine the cost of sales, encompassing the direct costs associated with delivering your products or services: [User inputs: cost of sales]. Calculate the gross profit by subtracting the cost of sales from the total revenue: [User inputs: Gross Profit]. Assess your overhead expenses, including rent, utilities, salaries, and other operational costs: [User inputs: Overhead]. Compute the operating income by subtracting the overhead expenses from the gross profit: [User inputs: Operating Income]. Make adjustments for any other income and/or expenses that impact the financial statement: [User inputs: Other Income and/or Expenses]. Finally, calculate the net profit, which represents the overall profitability of your business: [User inputs: Net Profit: The Bottom Line]. Describe the significance of each element in the profit/loss statement and any strategies you employ to enhance financial performance.”

7. “Imagine you are an expert accountant responsible for preparing profit/loss statements. You meticulously follow a systematic approach to ensure accurate financial reporting. Start by tracking the revenue generated during the reporting period: [User inputs: your revenue]. Determine the cost of sales, encompassing the direct costs associated with delivering your products or services: [User inputs: cost of sales]. Calculate the gross profit by subtracting the cost of sales from the total revenue: [User inputs: Gross Profit]. Assess your overhead expenses, including rent, utilities, salaries, and other operational costs: [User inputs: Overhead]. Compute the operating income by subtracting the overhead expenses from the gross profit: [User inputs: Operating Income]. Make adjustments for any other income and/or expenses that impact the financial statement: [User inputs: Other Income and/or Expenses]. Finally, calculate the net profit, which represents the overall profitability of your business: [User inputs: Net Profit: The Bottom Line]. Explain the importance of each element in the profit/loss statement and discuss any strategies you employ to optimize financial performance.”

8. “Put yourself in the shoes of a skilled accountant responsible for preparing profit/loss statements. You diligently follow a systematic process to ensure accurate financial reporting. Begin by tracking the revenue generated during the reporting period: [User inputs: your revenue]. Determine the cost of sales, encompassing the direct costs associated with delivering your products or services: [User inputs: cost of sales]. Calculate the gross profit by subtracting the cost of sales from the total revenue: [User inputs: Gross Profit]. Assess your overhead expenses, including rent, utilities, salaries, and other operational costs: [User inputs: Overhead]. Compute the operating income by subtracting the overhead expenses from the gross profit: [User inputs: Operating Income]. Make adjustments for any other income and/or expenses that impact the financial statement: [User inputs: Other Income and/or Expenses]. Finally, calculate the net profit, representing the bottom line of your profit/loss statement: [User inputs: Net Profit: The Bottom Line]. Describe the significance of each component in the statement and any strategies you employ to analyze and interpret the financial data for effective decision-making.”

9. “Imagine you are a meticulous accountant specializing in preparing profit/loss statements. You follow a systematic approach to ensure accurate and comprehensive financial reporting. Begin by tracking your revenue for the reporting period: [User inputs: your revenue]. Calculate the cost of sales, encompassing the direct costs associated with delivering your products or services: [User inputs: cost of sales]. Determine the gross profit by subtracting the cost of sales from the total revenue: [User inputs: Gross Profit]. Evaluate your overhead expenses, including rent, utilities, salaries, and other operational costs: [User inputs: Overhead]. Compute the operating income by subtracting the overhead expenses from the gross profit: [User inputs: Operating Income]. Make adjustments for any other income and/or expenses that impact the financial statement: [User inputs: Other Income and/or Expenses]. Finally, calculate the net profit, representing the overall profitability of your business: [User inputs: Net Profit: The Bottom Line]. Discuss the importance of each element in the profit/loss statement and any strategies you employ to optimize financial performance.”

10. “Put yourself in the role of a skilled accountant responsible for preparing profit/loss statements. You follow a systematic process to ensure accurate financial reporting. Start by tracking your revenue for the reporting period: [User inputs: your revenue]. Determine the cost of sales, encompassing the direct costs associated with delivering your products or services: [User inputs: cost of sales]. Calculate the gross profit by subtracting the cost of sales from the total revenue: [User inputs: Gross Profit]. Assess your overhead expenses, including rent, utilities, salaries, and other operational costs: [User inputs: Overhead]. Compute the operating income by subtracting the overhead expenses from the gross profit: [User inputs: Operating Income]. Make adjustments for any other income and/or expenses that impact the financial statement: [User inputs: Other Income and/or Expenses]. Finally, calculate the net profit, which represents the overall profitability of your business: [User inputs: Net Profit: The Bottom Line]. Explain the significance of each element in the profit/loss statement and any strategies you employ to enhance financial performance.”

Please ensure that the user replaces the [User inputs: your revenue], [User inputs: cost of sales], [User inputs: Gross Profit], [User inputs: Overhead], [User inputs: Operating Income], [User inputs: Other Income and/or Expenses], and [User inputs: Net Profit: The Bottom Line] placeholders with their specific values or calculations based on their own business or financial data.

Final Thoughts

ChatGPT prompts accountants to revolutionize workflow efficiency by providing a structured framework for accurate accounting processes. These prompts save time, offer tailored content, ensure clarity and structure, and facilitate professional communication. By utilizing ChatGPT prompts, accountants can streamline transactions, compute taxes, prepare forecasts, reconcile accounts, and analyze financial statements effectively. Embracing ChatGPT prompts empowers accountants to excel in their profession, deliver exceptional results, and contribute to client success. Elevate your accounting practice with ChatGPT prompts and experience heightened productivity and client satisfaction.

FAQs

Can ChatGPT be used for accounting?

Yes, ChatGPT can be used for accounting-related tasks and queries.

Can ChatGPT solve accounting questions?

Yes, ChatGPT can help in solving accounting questions by providing relevant information and explanations.

Can you use chat GPT for accounting?

Yes, ChatGPT can be used for accounting-related tasks and queries.

How will ChatGPT impact accounting?

ChatGPT can streamline accounting processes and provide real-time assistance, enhancing efficiency and accuracy.

Can ChatGPT replace accounting jobs?

No, ChatGPT cannot replace accounting jobs but can assist accountants in their work.

Can gpt4 do accounting?

No, ChatGPT 4 not doing Accounting

Did ChatGPT pass CPA exam?

No, ChatGPT is an artificial intelligence language model and does not possess the ability to take exams or acquire qualifications such as passing the CPA exam.

Will ChatGPT replace auditors?

No, ChatGPT is not designed to replace auditors but to assist them in their work.

Can AI replace CPA?

No, AI cannot replace a Certified Public Accountant (CPA), but it can enhance their work and provide support in various tasks.

Is AI replacing CA?

No, AI is not replacing Chartered Accountants (CAs), but it is augmenting their capabilities and transforming certain aspects of their work.