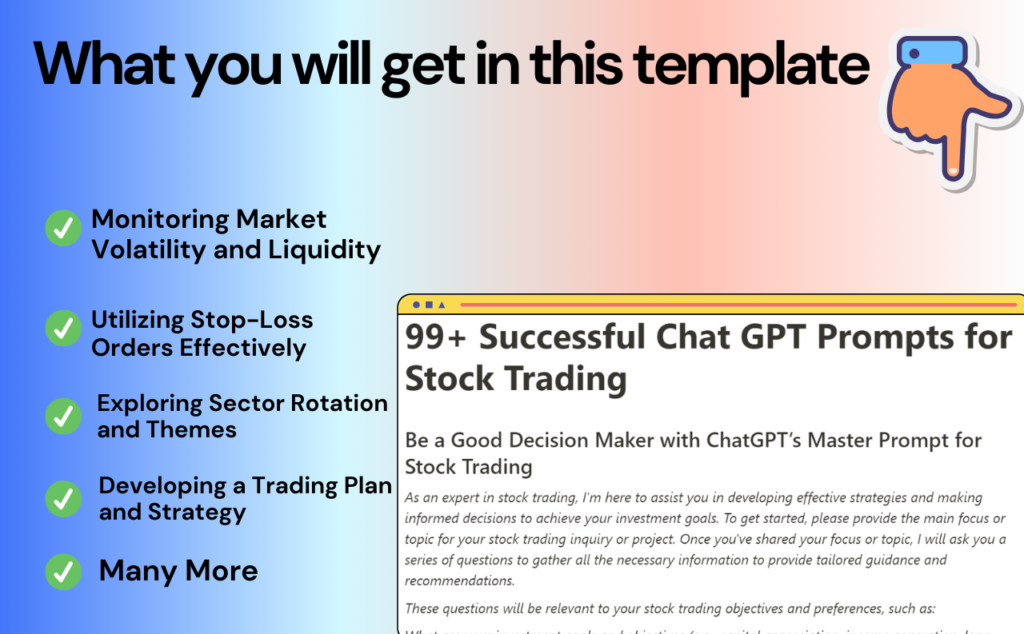

99+ Successful ChatGPT Prompts for Stock Trading to Empowering Smart Decisions

Wouldn’t it be nice if you could enhance your stock trading strategies effortlessly? Explore ChatGPT Prompts for Stock Trading. These Custom-Built ChatGPT Prompts offer invaluable insights, guiding you toward smarter investment decisions.

Are you seeking to enhance your comprehension of stock trading analysis? Unsure of where to begin or how to navigate through the market trends? ChatGPT Prompts for Stock Trading offers a solution to this common challenge. By providing clear prompts and insights, ChatGPT helps streamline the decision-making process, empowering traders to make informed choices confidently.

ChatGPT Prompts for Stock Trading offer clear guidance, empowering you to make confident decisions and maximize your investment potential effortlessly.

Why Choose ChatGPT Prompts for Stock Trading?

In the fast-paced world of stock trading, precision and efficiency are paramount. Utilizing ChatGPT Prompts for Stock Trading ensures accurate analysis and decision-making. With pre-built prompts tailored to financial markets, professionals can confidently navigate.

Imagine having customized prompts at your disposal, guiding you through market trends and facilitating informed choices. These prompts streamline the decision-making process, empowering traders to maximize returns and minimize risks, ultimately enhancing their financial success.

How to Use ChatGPT Prompts for Stock Trading?

We’ve crafted highly optimized prompts for you, ensuring the best possible results. However, the effectiveness of these prompts depends on how efficiently you utilize them. Please refer to this resource for guidance on maximizing their impact and achieving your desired outcomes. How to Use These Prompts?

Be a Good Decision Maker with ChatGPT’s Master Prompt for Stock Trading

As an expert in stock trading, I’m here to assist you in developing effective strategies and making informed decisions to achieve your investment goals. To get started, please provide the main focus or topic for your stock trading inquiry or project. Once you’ve shared your focus or topic, I will ask you a series of questions to gather all the necessary information to provide tailored guidance and recommendations.

These questions will be relevant to your stock trading objectives and preferences, such as:

What are your investment goals and objectives (e.g., capital appreciation, income generation, long-term wealth accumulation)? What is your risk tolerance and investment time horizon (e.g., short-term trading, medium-term investing, long-term holding)? Are you interested in trading individual stocks, exchange-traded funds (ETFs), options, futures, or other investment vehicles?

What is your level of experience and expertise in stock trading (e.g., beginner, intermediate, advanced)? Do you have any specific investment strategies or approaches that you prefer (e.g., value investing, growth investing, dividend investing, technical analysis)?

How much capital are you willing to invest in the stock market, and what is your budget for trading expenses (e.g., commissions, fees)? Are there any particular industries, sectors, or companies that you are interested in or have expertise in analyzing? What resources or tools do you currently use for stock analysis and research (e.g., financial websites, trading platforms, technical indicators)?

Have you established any criteria or criteria for selecting stocks or other securities to trade (e.g., fundamental analysis factors, technical analysis signals)? What is your preferred trading style (e.g., day trading, swing trading, position trading), and how actively do you plan to monitor and manage your trades?

You, as the user, will answer each question one by one, and I will extract as much information as I can to provide tailored advice and recommendations for your stock trading endeavors.

After gathering all the necessary information, I will offer personalized guidance on stock selection, portfolio diversification, risk management, trading strategies, and other key aspects of successful stock trading. Whether you’re a novice investor looking to get started or an experienced trader seeking to refine your approach, I’ll help you navigate the complexities of the stock market and make well-informed investment decisions.

4 Powerful ChatGPT Prompts for Stock Trading

- Stock Trading Strategy Development:

Assume the role of a Stock Trading Mentor. Develop a comprehensive trading strategy for [input your target market or specific stocks]. Outline key factors such as entry and exit criteria, risk management techniques, and position sizing strategies. Discuss the use of technical analysis indicators, fundamental analysis metrics, and market sentiment analysis in making trading decisions. Provide guidelines for adapting the strategy to different market conditions.

- Risk Management and Portfolio Diversification:

Act as a Risk Management Consultant for Stock Traders. Guide effective risk management practices and portfolio diversification strategies. Discuss the importance of setting stop-loss levels, managing position sizes, and hedging against market volatility. Recommend asset allocation techniques to spread risk across different sectors, asset classes, and geographic regions. Provide tips for monitoring portfolio performance and making adjustments as needed.

- Trading Psychology and Emotional Discipline:

Imagine you’re a Trading Psychologist. Discuss the psychological challenges faced by stock traders and provide strategies for maintaining emotional discipline and mental resilience. Explore topics such as overcoming fear and greed, managing losses, and staying focused during periods of market uncertainty. Provide techniques for developing a positive trading mindset, practicing mindfulness, and handling stress effectively. Offer advice on maintaining work-life balance and avoiding burnout in the fast-paced world of stock trading.

- Market Analysis and Trade Ideas Generation:

Act as a Market Analyst for Stock Traders. Conduct in-depth market analysis and generate trade ideas for [input your target market or specific stocks]. Utilize technical analysis tools, chart patterns, and trend indicators to identify potential trading opportunities. Discuss the impact of macroeconomic factors, corporate earnings reports, and geopolitical events on stock prices. Provide insights into developing a watchlist, scanning for breakout or reversal patterns, and executing trades with precision timing.

99+ Dynamic ChatGPT Prompts for Stock Trading to Improve Decision Making

- Analyzing Market Trends and Patterns:

Explore historical market data and identify trends, patterns, and correlations to make informed trading decisions and predict future price movements.

- Utilizing Technical Analysis Tools:

Utilize technical analysis tools, such as moving averages, MACD, RSI, and Bollinger Bands, to analyze price charts, identify entry and exit points, and assess market sentiment.

- Implementing Risk Management Strategies:

Develop and implement risk management strategies, including setting stop-loss orders, position sizing, diversification, and portfolio rebalancing, to protect capital and minimize losses in volatile markets.

- Staying Informed with Market News and Updates:

Stay informed about market news, economic indicators, earnings reports, and geopolitical events that may impact stock prices, using reputable financial news sources and platforms.

- Exploring Fundamental Analysis Techniques:

Conduct fundamental analysis by evaluating company financials, earnings reports, balance sheets, and industry trends to assess the intrinsic value of stocks and identify investment opportunities.

- Monitoring Market Volatility and Liquidity:

Monitor market volatility and liquidity levels, such as bid-ask spreads and trading volumes, to gauge market conditions and adjust trading strategies accordingly.

- Exploring Different Trading Strategies:

Experiment with different trading strategies, such as day trading, swing trading, momentum trading, and value investing, to find a strategy that aligns with your risk tolerance and investment goals.

- Utilizing Stop-Loss Orders Effectively:

Implement stop-loss orders to protect profits and limit losses by automatically selling a stock if it reaches a predetermined price level, minimizing emotional decision-making and potential losses.

- Understanding Market Order Types:

Understand different types of market orders, including market orders, limit orders, stop orders, and trailing stop orders, and when to use each order type effectively.

- Exploring Sector Rotation and Themes:

Explore sector rotation strategies and thematic investing approaches to capitalize on emerging trends and industry sectors with growth potential.

- Developing a Trading Plan and Strategy:

Develop a comprehensive trading plan and strategy outlining your trading goals, risk tolerance, entry and exit criteria, and money management rules to guide your trading decisions.

- Utilizing Trading Simulations and Paper Trading:

Practice trading strategies and gain experience in a risk-free environment using trading simulations or paper trading accounts before committing real capital to the market.

- Utilizing Trading Platforms and Tools:

Familiarize yourself with trading platforms and tools offered by brokerage firms, such as charting software, order execution platforms, and mobile trading apps, to streamline trading processes.

- Managing Emotions and Psychology:

Manage emotions and psychological biases, such as fear, greed, and overconfidence, by maintaining discipline, adhering to your trading plan, and staying objective in decision-making.

- Learning from Trading Mistakes and Setbacks:

Learn from trading mistakes and setbacks by analyzing past trades, identifying areas for improvement, and adapting your trading strategy accordingly to become a more successful trader.

- Exploring Options and Derivatives Trading:

Explore options and derivatives trading strategies to leverage and hedge positions, capitalize on volatility, and generate income from your stock portfolio.

- Networking with Experienced Traders:

Network with experienced traders, join online trading communities, forums, and social media groups, and attend trading seminars and workshops to learn from others’ experiences and share insights.

- Utilizing Algorithmic Trading Strategies:

Explore algorithmic trading strategies and automated trading systems to execute trades based on predefined rules, parameters, and algorithms, improving efficiency and removing emotion from trading decisions.

- Staying Disciplined and Consistent:

Maintain discipline and consistency in your trading approach by sticking to your trading plan, avoiding impulsive decisions, and focusing on long-term success rather than short-term gains.

- Seeking Continuous Learning and Education:

Commit to continuous learning and education in the field of stock trading by reading books, attending webinars, taking online courses, and staying updated with the latest market developments and trends.

- Analyzing Market Sentiment and News:

Evaluate market sentiment and news sentiment indicators, such as the Fear and Greed Index, social media sentiment analysis, and news sentiment analysis tools, to gauge investor sentiment and market direction.

- Exploring Candlestick Patterns and Chart Patterns:

Study candlestick patterns, such as doji, hammer, and engulfing patterns, and chart patterns, such as triangles, flags, and head and shoulders patterns, to identify potential trend reversals and continuation signals.

- Implementing Seasonal Trading Strategies:

Implement seasonal trading strategies based on historical market patterns, such as the January Effect, Santa Claus Rally, and seasonal sector rotation trends, to capitalize on seasonal market anomalies.

- Utilizing Economic Calendar and Event Analysis:

Utilize an economic calendar to track important economic events, central bank announcements, and key economic indicators, and analyze their potential impact on stock prices and market volatility.

- Exploring Sector ETFs and Index Funds:

Explore sector-specific exchange-traded funds (ETFs) and index funds to gain exposure to specific industry sectors, diversify your portfolio, and capitalize on sector rotation opportunities.

- Analyzing Insider Trading Activity:

Monitor insider trading activity by corporate insiders, including executives, directors, and large shareholders, to identify potential buying or selling signals and gain insights into corporate sentiment.

- Exploring Value Investing Principles:

Apply value investing principles, such as analyzing intrinsic value, margin of safety, and business fundamentals, to identify undervalued stocks with long-term growth potential and favorable risk-reward profiles.

- Understanding Short Selling Strategies:

Understand short-selling strategies, including shorting individual stocks, using inverse ETFs, and trading options, to profit from falling stock prices and bearish market conditions.

- Exploring Growth Investing Strategies:

Explore growth investing strategies, such as investing in high-growth companies, disruptive technologies, and emerging markets, to capitalize on long-term growth opportunities and outperform the market.

- Utilizing Technical Indicator Overlays:

Utilize technical indicator overlays, such as moving average convergence divergence (MACD) and Ichimoku Cloud, to confirm trend signals, identify support and resistance levels, and improve market timing.

Get Membership for More Prompts

- Exploring Penny Stock Trading Strategies:

Explore penny stock trading strategies, such as trading low-priced stocks with high volatility, momentum plays, and pump-and-dump schemes, while managing risks associated with penny stocks.

- Implementing Swing Trading Strategies:

Implement swing trading strategies based on short- to medium-term price momentum and trend reversals, using technical analysis tools and chart patterns to identify entry and exit points.

- Utilizing Sector Rotation Strategies:

Utilize sector rotation strategies to rotate capital into outperforming sectors and industries, based on economic cycles, sector-specific catalysts, and relative strength analysis.

- Exploring Options Trading Strategies:

Explore options trading strategies, such as covered calls, protective puts, and option spreads, to hedge positions, generate income, and leverage trading opportunities with limited risk.

- Analyzing Market Breadth Indicators:

Analyze market breadth indicators, such as advance-decline lines, new highs-new lows, and cumulative volume indicators, to assess the overall health and breadth of the stock market.

- Utilizing Fundamental Screening Criteria:

Utilize fundamental screening criteria, such as earnings growth, revenue growth, profit margins, and return on equity, to filter and identify potential investment candidates for further analysis.

- Exploring Dividend Investing Strategies:

Explore dividend investing strategies, such as investing in dividend-paying stocks, dividend growth investing, and dividend reinvestment plans (DRIPs), to generate passive income and build wealth over time.

- Understanding Risk-Reward Ratios:

Calculate risk-reward ratios for each trade or investment opportunity, assessing potential downside risk versus upside potential, and maintain a favorable risk-reward balance in your portfolio.

- Utilizing Position Sizing and Portfolio Allocation:

Determine appropriate position sizes and portfolio allocation percentages based on risk tolerance, investment objectives, and market conditions, optimizing portfolio diversification and risk management.

- Studying Behavioral Finance Principles:

Study behavioral finance principles, such as cognitive biases, herd behavior, and prospect theory, to understand investor psychology and emotions, and make more rational and disciplined investment decisions.

- Analyzing Market Sentiment and News:

Evaluate market sentiment and news sentiment indicators to gauge investor sentiment and market direction.

- Exploring Candlestick Patterns and Chart Patterns:

Study candlestick patterns and chart patterns to identify potential trend reversals and continuation signals.

- Implementing Seasonal Trading Strategies:

Implement seasonal trading strategies to capitalize on seasonal market anomalies.

- Utilizing Economic Calendar and Event Analysis:

Utilize an economic calendar to track important economic events and analyze their potential impact on stock prices.

- Exploring Sector ETFs and Index Funds:

Explore sector-specific exchange-traded funds (ETFs) and index funds to gain exposure to specific industry sectors.

- Analyzing Insider Trading Activity:

Monitor insider trading activity by corporate insiders to gain insights into corporate sentiment.

- Exploring Value Investing Principles:

Apply value investing principles to identify undervalued stocks with long-term growth potential.

- Understanding Short Selling Strategies:

Understand short-selling strategies to profit from falling stock prices and bearish market conditions.

- Exploring Growth Investing Strategies:

Explore growth investing strategies to capitalize on long-term growth opportunities.

- Utilizing Technical Indicator Overlays:

Utilize technical indicator overlays to confirm trend signals and identify support and resistance levels.

- Exploring Penny Stock Trading Strategies:

Explore penny stock trading strategies while managing risks associated with penny stocks.

- Implementing Swing Trading Strategies:

Implement swing trading strategies based on short- to medium-term price momentum.

- Utilizing Sector Rotation Strategies:

Utilize sector rotation strategies based on economic cycles and relative strength analysis.

- Exploring Options Trading Strategies:

Explore options trading strategies to hedge positions and leverage trading opportunities.

- Analyzing Market Breadth Indicators:

Analyze market breadth indicators to assess the overall health of the stock market.

- Utilizing Fundamental Screening Criteria:

Utilize fundamental screening criteria to filter potential investment candidates.

- Exploring Dividend Investing Strategies:

Explore dividend investing strategies to generate passive income and build wealth over time.

- Understanding Risk-Reward Ratios:

Calculate risk-reward ratios for each trade or investment opportunity.

- Utilizing Position Sizing and Portfolio Allocation:

Determine appropriate position sizes and portfolio allocation percentages.

- Studying Behavioral Finance Principles:

Study behavioral finance principles to make more rational and disciplined investment decisions.

Sell Your Prompts Here

Are you good at writing prompts?

Put your expertise on display here and get paid!

- Analyzing Market Volatility Patterns:

Analyze market volatility patterns to anticipate potential price movements and manage risk effectively.

- Exploring Algorithmic Trading Strategies:

Explore algorithmic trading strategies to automate trade execution and capitalize on market inefficiencies.

- Utilizing Options Greeks for Risk Management:

Utilize options Greeks (Delta, Gamma, Theta, Vega) to manage risk exposure and optimize options trading strategies.

- Implementing Trend Following Techniques:

Implement trend-following techniques to ride the momentum and capture profitable trends in the market.

- Exploring Quantitative Trading Models:

Explore quantitative trading models to develop systematic trading strategies based on statistical analysis.

- Utilizing Market Sentiment Indicators:

Utilize market sentiment indicators, such as the put/call ratio and the VIX, to gauge investor sentiment.

- Exploring Pair Trading Strategies:

Explore pair trading strategies to profit from relative price movements between correlated assets.

- Understanding Market Order Types:

Understand different market order types, including market orders, limit orders, and stop orders, and when to use them.

- Exploring Seasonal Trading Patterns:

Explore seasonal trading patterns to identify recurring opportunities based on historical market data.

- Utilizing Multi-Timeframe Analysis:

Utilize multi-timeframe analysis to gain a comprehensive view of price action and market trends.

- Implementing Risk Management Techniques:

Implement risk management techniques, such as stop-loss orders and position sizing, to protect capital.

- Exploring Momentum Trading Strategies:

Explore momentum trading strategies to capitalize on strong and sustained price trends.

- Understanding Market Microstructure:

Understand market microstructure concepts, including order flow, liquidity, and market depth.

- Utilizing Fundamental Analysis Tools:

Utilize fundamental analysis tools, such as financial statements and valuation metrics, to evaluate investment opportunities.

- Exploring Market Regime Detection:

Explore market regime detection techniques to adapt trading strategies to different market environments.

- Implementing Mean Reversion Strategies:

Implement mean reversion strategies to profit from price reversals after periods of excessive optimism or pessimism.

- Understanding Market Correlation Analysis:

Understand market correlation analysis to identify relationships between asset classes and diversify portfolios effectively.

- Exploring High-Frequency Trading Strategies:

Explore high-frequency trading strategies to capitalize on short-term market inefficiencies.

- Utilizing Economic Indicator Analysis:

Utilize economic indicator analysis to anticipate changes in economic conditions and their impact on financial markets.

- Implementing Risk Parity Strategies:

Implement risk parity strategies to allocate portfolio risk more evenly across asset classes and improve risk-adjusted returns.

- Analyzing Candlestick Patterns:

Analyze candlestick patterns to identify potential trend reversals or continuation signals in price charts.

- Exploring Sector Rotation Strategies:

Explore sector rotation strategies to capitalize on shifting market leadership and sector performance.

- Utilizing Options Strategies for Income Generation:

Utilize options strategies, such as covered calls and cash-secured puts, to generate consistent income.

- Implementing Machine Learning in Trading:

Implement machine learning techniques to develop predictive models for analyzing market data and making trading decisions.

- Exploring Exchange-Traded Funds (ETFs):

Explore exchange-traded funds (ETFs) as a cost-effective way to gain exposure to diversified asset classes or market sectors.

- Understanding Volatility Trading Strategies:

Understand volatility trading strategies, such as straddles and strangles, to profit from changes in market volatility.

- Utilizing Technical Indicators for Trading Signals:

Utilize technical indicators, such as moving averages and relative strength index (RSI), for generating trading signals.

- Exploring Alternative Investments:

Explore alternative investments, such as commodities and real estate, to diversify investment portfolios and mitigate risk.

- Implementing Portfolio Rebalancing Techniques:

Implement portfolio rebalancing techniques to maintain desired asset allocations and optimize risk-adjusted returns.

- Understanding Market Liquidity Dynamics:

Understand market liquidity dynamics and their impact on trade execution and price slippage.

- Utilizing Options Strategies for Hedging:

Utilize options strategies, such as protective puts and collars, for hedging against downside risk in investment portfolios.

- Exploring Social Trading Platforms:

Explore social trading platforms to follow and replicate the trading strategies of experienced investors or trading experts.

- Understanding Market Order Flow Analysis:

Understand market order flow analysis to gauge buying and selling pressure and anticipate price movements.

- Utilizing Cryptocurrency Trading Strategies:

Utilize cryptocurrency trading strategies to capitalize on price volatility and market inefficiencies in digital asset markets.

- Exploring Dividend Investing Strategies:

Explore dividend investing strategies to build a portfolio of income-generating assets for long-term wealth accumulation.

- Implementing Tax-Efficient Trading Strategies:

Implement tax-efficient trading strategies, such as tax-loss harvesting and asset location optimization, to minimize tax liabilities.

- Understanding Risk-Adjusted Return Metrics:

Understand risk-adjusted return metrics, such as the Sharpe ratio and Sortino ratio, for evaluating investment performance.

- Utilizing Market Sentiment Analysis Tools:

Utilize market sentiment analysis tools, such as social media sentiment analysis and news sentiment indicators, for market insights.

- Exploring Global Macro Trading Strategies:

Explore global macro trading strategies to capitalize on macroeconomic trends and geopolitical events.

- Implementing Dollar-Cost Averaging (DCA):

Implement dollar-cost averaging (DCA) as a disciplined approach to investing by regularly purchasing assets over time regardless of market conditions.

Final Thoughts

In conclusion, ChatGPT Prompts for Stock Trading offers a valuable solution for busy professionals navigating the complexities of the financial market. With tailored prompts at their disposal, traders can make informed decisions efficiently, saving time and energy. By using these prompts, they can optimize their trading strategies and maximize their investment potential. Happy trading!