99+ Proven ChatGPT Prompts for Financial Analysis Ensuring Quick and Insightful Report Creation

Conducting financial analysis can be overwhelming, especially if you’re unsure how to structure your queries. Enter ChatGPT Prompts for Financial Analysis. Designed to guide you through income statements, balance sheets, and more, these best ChatGPT prompts simplify the complex world of financial reporting.

Ever find yourself lost in the financial analysis maze, unsure how to tackle the complexities? Crafting reports can be puzzling without the right guidance. Many face the challenge of crafting in-depth reports without a clear starting point. With ChatGPT Prompts for Financial Analysis, simplifying this process becomes easy, addressing the common struggle of initiating comprehensive financial assessments.

No more navigating complex jargon! Explore the world of ChatGPT and revolutionize your financial analysis. ChatGPT’s prompts guide you effortlessly through the complex landscape of financial data.

Why Choose ChatGPT Prompts for Financial Analysis?

Mastering financial analysis is like having a superpower for businesses and accuracy is the key. These ChatGPT Prompts for Financial Analysis are transforming how you accurately navigate and understand financial complexities.

These prompts aren’t just about data; Whether you’re managing a household budget or steering a corporate ship, these prompts can be your reliable compass, bringing efficiency, clarity, and a touch of simplicity to your financial analysis journey.

Empower yourself with the ability to make informed decisions, positively impacting profits or personal savings.

Speed Up Your Financial Analysis Reports with ChatGPT’s Master Prompt

Assist me as an Expert Financial Analyst in creating a tailored Financial Analysis Report for [your Company title]. To begin, the main focus for the Finance Report is []. Once I share the [details of your company’s income statement, including revenue, expenses, and net income], You will ask me a series of questions step by step to gather all the necessary information for the Report. These questions will be relevant to the Financial Analysis like what are the details of my company’s balance sheet, highlighting assets, liabilities, and equity, company’s cash flow statement, covering operating, investing, and financing activities, profit and loss statement, sources of revenue for my company, company’s expenses, categorizing them into operational, administrative, and other relevant areas, company’s debt and equity structure, and budgeted financials versus actual performance. Me, as the user, will answer each question one by one, and You will extract as much information as You can to ensure the content meets my needs. There will be at least 5 questions and up to 10 questions in total, all aimed at understanding my requirements and creating a tailored finance report. The next question will be asked only after i provide response to the previous one, like a survey with only one question at a time. After these questions, You will write a comprehensive financial analysis report for my company about what I can expect from You with all the headings.

4 Outstanding ChatGPT Prompts for Optimal Financial Analysis

- Income Statement

Act as an Expert Financial Analyst in creating a tailored Financial Analysis Report. Generate Income Statement for [your Company title]. To begin, details of my company’s income statement are [revenue], [expenses (provide a breakdown of the various expenses incurred by your company, including operating, administrative, and any other relevant categories)], and [net income for the current fiscal period]. I have shared the income statement details, now provide with me an income statement for my company.

- Balance Sheet

Act as an Expert Financial Analyst in creating a tailored Financial Analysis Report. Generate Balance Sheet for [your Company title]. To begin, details for my company are [total value of assets held by your company], [total liabilities incurred by your company], and [equity details]. I have shared the details, now provide with me a Balance Sheet for my company.

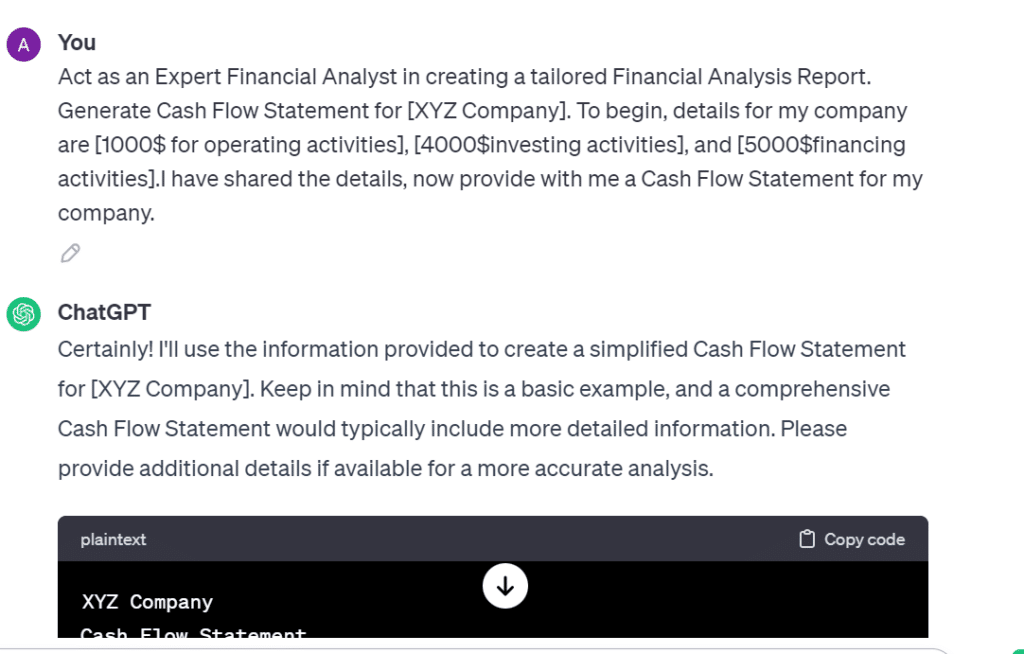

- Cash Flow Statement

Act as an Expert Financial Analyst in creating a tailored Financial Analysis Report. Generate Cash Flow Statement for [your Company title]. To begin, details for my company are [operating activities], [investing activities], and [financing activities].I have shared the details, now provide with me a Cash Flow Statement for my company.

- Profit and Loss Statement

Act as an Expert Financial Analyst in creating a tailored Financial Analysis Report. Generate Profit and Loss Statement for [your Company title]. To begin, details for my company are [various sources contributing to your company’s revenue] and [ details on any notable expenses]. I have shared the details, now provide with me a Profit and Loss Statement for my company.

99+ Custom-Built ChatGPT Prompts for developing Financial Analysis Reports

- Cash Ratio Analysis:

Evaluate my company’s cash ratio, highlighting the portion of current liabilities covered by cash and cash equivalents.

- Operational Cash Flow Breakdown:

Break down the operational cash flows into key components, such as customer collections, supplier payments, and operating expenses.

- Inventory Turnover Analysis:

Analyze inventory turnover to assess how efficiently my company is managing its inventory levels.

- Financial Leverage Impact:

Assess the impact of financial leverage on my company’s return on equity (ROE) and recommend adjustments.

- EBITDA Margin Analysis:

Calculate and analyze EBITDA margins to assess the operating profitability of my company.

- Accounts Receivable Aging Analysis:

Analyze accounts receivable aging to identify overdue receivables and propose strategies for improvement.

- Intangible Asset Valuation:

Conduct a valuation of intangible assets, such as patents or trademarks, and assess their impact on financial statements.

- Depreciation Policy Optimization:

Evaluate the depreciation policy and recommend optimizations to align with the useful life of assets.

- Treasury Stock Impact:

Analyze the impact of treasury stock transactions on the equity section of the balance sheet.

- Retained Earnings Utilization:

Recommend strategies for the effective utilization of retained earnings to maximize shareholder value.

- Prepaid Expenses Assessment:

Assess the classification and impact of prepaid expenses on the balance sheet and income statement.

- Deferred Tax Liability Analysis:

Analyze deferred tax liabilities, considering the timing differences between accounting and tax reporting.

- Employee Stock Option Valuation:

Conduct a valuation of employee stock options and assess their impact on financial statements.

- Goodwill Impairment Testing:

Provide guidance on conducting goodwill impairment testing and its implications on financial reporting.

- Accrual Accounting Benefits:

Highlight the benefits of accrual accounting in providing a more accurate representation of financial performance.

- Fixed Assets Turnover Analysis:

Analyze fixed assets turnover to assess how efficiently my company is utilizing its fixed assets.

- Equity Method Investment Assessment:

Evaluate investments accounted for using the equity method and assess their impact on financial statements.

- Cost of Goods Sold (COGS) Optimization:

Recommend strategies for optimizing the cost of goods sold to improve gross profit margins.

- Employee Benefit Obligations Analysis:

Analyze employee benefit obligations, such as pensions and healthcare, and assess their impact on financial statements.

Prompts for Professionals

- Impairment Loss Recognition:

Guide on recognizing and accounting for impairment losses on long-lived assets.

- Revenue Breakdown:

Break down the sources of revenue for my company and specify the percentage contribution of each. Input: [Enter specific revenue sources]

- Expense Analysis:

Categorize my company’s expenses into operational, administrative, and other relevant areas, highlighting major cost centers. Input: [Specify cost categories]

- Financial Ratios:

Calculate and analyze key financial ratios, such as liquidity, profitability, and leverage ratios, for a holistic view of financial health.

- Budget vs. Actuals:

Compare budgeted financials with actual performance, identifying any significant variances and their implications.

- Industry Benchmarking:

Conduct a benchmark analysis against industry standards to evaluate my company’s financial performance.

- Market Trends Impact:

Assess how current market trends may impact my company’s financial outlook and profitability.

- Investment Opportunities:

Explore potential investment opportunities based on my company’s financial strengths and weaknesses.

- Cost Optimization Strategies:

Suggest strategies for optimizing costs and improving operational efficiency based on financial analysis findings.

- Cash Flow Management:

Develop recommendations for effective cash flow management to ensure financial stability and growth.

- Merger & Acquisition Analysis:

Evaluate the financial implications and potential benefits of mergers or acquisitions for my company.

- Risk Assessment:

Identify and assess financial risks my company may face, proposing risk mitigation strategies.

- Working Capital Optimization:

Provide insights into optimizing working capital to enhance liquidity and overall financial performance.

- Long-Term Financial Planning:

Develop a long-term financial plan considering growth objectives, capital investments, and future revenue streams.

- Profit Margin Improvement:

Propose strategies to enhance profit margins by analyzing revenue streams and cost structures.

- Financial Reporting Compliance:

Ensure my company’s adherence to financial reporting regulations and suggest improvements for compliance.

- Scenario Analysis:

Conduct scenario analysis to assess the potential impact of different economic scenarios on my company’s finances.

- Technology Investment Impact:

Evaluate the financial impact of potential technology investments on my company’s overall performance.

- Sustainability Integration:

Assess the financial implications of integrating sustainability initiatives into my company’s operations.

- Stakeholder Value Enhancement:

Provide recommendations for enhancing stakeholder value through strategic financial decisions and actions.

- Company Overview:

Provide a brief overview of my company, including its industry, size, and key operations, for a comprehensive financial analysis.

- Market Share Analysis:

Analyze and evaluate my company’s market share within the industry, considering competitors and potential growth opportunities.

- Economic Indicators Impact:

Examine the impact of key economic indicators (e.g., inflation rates, interest rates) on my company’s financial performance.

- Debt Management Strategies:

Provide strategies for effective debt management, considering the current debt levels and future financial obligations.

- Customer Profitability Analysis:

Conduct a profitability analysis based on customer segments to identify high-value customer groups and optimize marketing strategies.

- Liquidity Analysis:

Assess my company’s liquidity position, including current and quick ratios, to ensure short-term financial stability.

- Dividend Policy Recommendations:

Recommendations on dividend policy, considering current earnings, growth prospects, and shareholder expectations.

- Regression Analysis for Forecasting:

Utilize regression analysis techniques for financial forecasting, considering historical data and relevant variables.

- Tax Planning Strategies:

Propose tax planning strategies to optimize my company’s tax position and maximize after-tax profits.

- Capital Expenditure Justification:

Evaluate proposed capital expenditures, providing justification based on expected returns and long-term strategic goals.

- SWOT Analysis for Financial Decision-Making:

Conduct a SWOT analysis specifically focused on financial aspects to inform strategic decision-making.

- Earnings Quality Assessment:

Assess the quality of my company’s earnings, considering factors such as accruals, non-recurring items, and accounting policies.

- Financial Forecast Sensitivity Analysis:

Perform sensitivity analysis on financial forecasts to identify potential vulnerabilities and assess the impact of various scenarios.

- Credit Risk Analysis:

Evaluate credit risk associated with customers and vendors, proposing risk mitigation strategies for financial stability.

- Product Profitability Assessment:

Analyze the profitability of individual products or services, recommending adjustments based on performance.

- Foreign Exchange Risk Management:

Recommend strategies for managing foreign exchange risk, especially if my company operates in international markets.

- Employee Compensation Analysis:

Analyze the impact of employee compensation on financial performance and propose adjustments for optimal cost-effectiveness.

- Financial Communication Strategy:

Develop a strategy for effectively communicating financial performance to stakeholders, including investors and employees.

- Financial Distress Early Warning Signs:

Identify early warning signs of financial distress and propose preemptive measures for financial sustainability.

- Investor Relations Enhancement:

Provide recommendations to enhance investor relations, fostering positive relationships and building confidence in financial markets.

- Benchmarking Operational Efficiency:

Benchmark my company’s operational efficiency against industry standards, suggesting improvements.

- Dividend Discount Model (DDM) Analysis:

Analyze my company’s valuation using the Dividend Discount Model, considering future dividend payments.

- Innovation Investment Evaluation:

Evaluate the financial impact of potential investments in innovation and technology on my company’s overall performance.

- Net Present Value (NPV) Calculation:

Calculate the Net Present Value for a proposed project, considering cash inflows and outflows over time.

- Implications of Financial Restatements:

Discuss the implications of financial restatements on my company’s financial reporting and credibility.

- Cost of Capital Determination:

Determine the cost of capital for my company, considering the weighted average cost of debt and equity.

- Revenue Recognition Policy Assessment:

Assess the impact of revenue recognition policies on my company’s financial statements and compliance.

- Debt-Equity Ratio Analysis:

Analyze the debt-equity ratio to evaluate my company’s capital structure and financial risk.

- Economic Value Added (EVA) Calculation:

Calculate Economic Value Added to assess my company’s ability to generate shareholder value.

- Credit Scoring Model Implementation:

Explore the implementation of a credit scoring model to assess the creditworthiness of customers.

- Forecasting Free Cash Flows:

Guide on forecasting free cash flows, considering operating cash flows and capital expenditures.

- Customer Lifetime Value (CLV) Assessment:

Assess the Customer Lifetime Value to understand the long-term value of customer relationships.

- Income Tax Provision Calculation:

Calculate the income tax provision, considering deferred tax assets and liabilities.

- Cost-Volume-Profit (CVP) Analysis:

Conduct a Cost-Volume-Profit analysis to understand the relationships between costs, volume, and profits.

- Benchmarking Profitability Margins:

Benchmark my company’s profitability margins against industry peers to identify areas for improvement.

- Financial Modeling Best Practices:

Discuss best practices for creating effective and accurate financial models for decision-making.

- Inflation Impact on Financial Statements:

Analyze the impact of inflation on financial statements and suggest adjustments for accuracy.

- Variable vs. Fixed Costs Analysis:

Differentiate between variable and fixed costs and assess their impact on my company’s financial performance.

- Employee Stock Purchase Plan (ESPP) Evaluation:

Evaluate the financial implications of implementing an Employee Stock Purchase Plan.

- Liquidity vs. Solvency Assessment:

Distinguish between liquidity and solvency, and assess their importance in financial analysis.

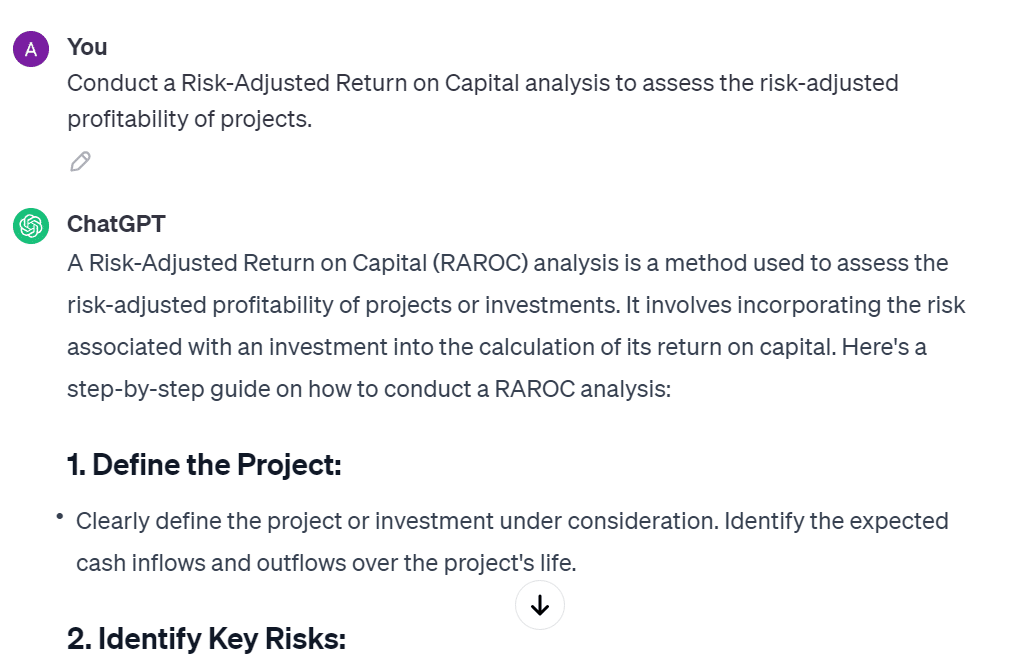

- Risk-Adjusted Return on Capital (RAROC) Analysis:

Conduct a Risk-Adjusted Return on Capital analysis to assess the risk-adjusted profitability of projects.

- Comparative Financial Statement Analysis:

Perform a comparative analysis of my company’s financial statements over multiple periods, highlighting trends and variations.

- Capital Structure Optimization:

Evaluate the optimal capital structure for my company, considering the mix of debt and equity for cost efficiency.

- Cash Conversion Cycle Assessment:

Assess the cash conversion cycle to optimize the time it takes to convert sales into cash.

- Earnings Management Detection:

Provide insights into detecting potential earnings management practices and ensuring financial statement integrity.

- Strategic Cost Analysis:

Conduct a strategic cost analysis to identify cost drivers and areas for strategic cost reduction.

- Peer Group Analysis:

Compare my company’s financial performance against a peer group to identify relative strengths and weaknesses.

- Tax Efficiency Strategies:

Recommend tax efficiency strategies to minimize the overall tax burden and maximize after-tax profits.

- Valuation Using Comparable Companies:

Utilize the Comparable Companies Analysis method to value my company within the industry context.

- Economic Profit Measurement:

Calculate economic profit as a measure of true economic value created by my company.

- Financial Statement Footnote Analysis:

Analyze financial statement footnotes to gain deeper insights into accounting policies and potential risks.

- Monte Carlo Simulation for Risk Analysis:

Employ Monte Carlo simulation for risk analysis, particularly in forecasting uncertain financial scenarios.

- Budget Variance Analysis:

Analyze budget variances to understand discrepancies between planned and actual financial performance.

- Break-Even Analysis:

Conduct a break-even analysis to determine the level of sales needed to cover costs and achieve profitability.

- Merits of Zero-Based Budgeting:

Discuss the merits and challenges of implementing zero-based budgeting as a budgeting approach.

- Post-Merger Financial Integration:

Provide guidance on the financial integration process following a merger, ensuring a seamless transition.

- Revenue Recognition Changes Impact:

Examine the impact of changes in revenue recognition standards (e.g., ASC 606) on financial reporting.

- Cost of Capital Sensitivity Analysis:

Perform a sensitivity analysis on the cost of capital to assess the impact on project feasibility and investment decisions.

- Financial Distress Prediction Models:

Explore the implementation of financial distress prediction models to anticipate and mitigate potential financial challenges.

- Sustainability Reporting Frameworks:

Discuss various sustainability reporting frameworks and their implications on financial disclosure.

- Blockchain Technology in Financial Reporting:

Evaluate the potential applications of blockchain technology in enhancing transparency and accuracy in financial reporting.

Get 99+ ChatGPT Prompts for Financial Analysis – Complete List Here!

Free Prompts forever – Complete Financial Analysis Prompts List

Final thoughts

In the financial world, ChatGPT Prompts for Financial Analysis are like your helpful guide, making tricky stuff easy. They turn complex numbers into smart choices for families and businesses. Whether it’s your home budget or work finances, ChatGPT makes things simple. With tailored prompts, it transforms complex data into actionable insights. Happy Analyzing!