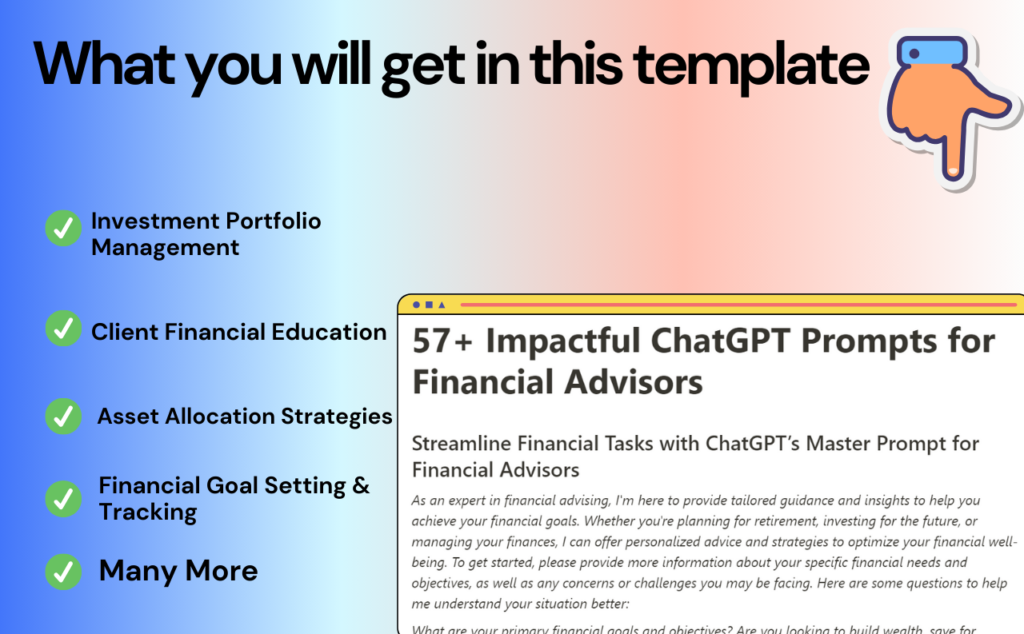

57+ Impactful ChatGPT Prompts for Financial Advisors to Get Money Guidance

Does your to-do list for financial stuff keep getting longer? Get ChatGPT Prompts for Financial Advisors Now. These Powerful ChatGPT Prompts simplify complex analysis, offering customized guidance.

Are you not feeling confident about managing your clients’ finances? ChatGPT Prompts for Financial Advisors can guide you through prompts to simplify the process. Our intuitive prompts help you streamline your financial advisory tasks, cutting through the confusion and bringing clarity to your client’s financial picture.

ChatGPT Prompts for Financial Advisors is your go-to solution because ChatGPT takes care of time-consuming tasks and empowers your financial practice.

Capabilities vs Limitations of ChatGPT Prompts for Financial Advisors

ChatGPT is great at helping financial advisors summarize tricky financial stuff like reports, market trends, and investment ideas. It’s super handy because it quickly breaks down lots of data into short summaries. This means advisors can understand the most important bits fast and make smart decisions. Plus, ChatGPT can explain tricky finance words, which makes it easier for advisors to talk to their clients and help them understand better.

But, even though ChatGPT is awesome, it’s not perfect. It can process a fixed amount of text in one go. So if you have longer documents, you need to split them wisely. Also, while it’s good at giving quick summaries, it might not catch all the small details or give the same kind of advice as a real person can.

So, even though ChatGPT is a great tool, it works best when advisors use it alongside their expertise to make sure they get the best results for their clients.

Prompts for Professionals

Why ChatGPT Prompts for Financial Advisors are Helpful?

These prompts create suggestions that make the advisor’s job easier and better. They guide advisors to understand what clients need, predict changes in the money world, and come up with personalized solutions accurately. With its smart technology, ChatGPT makes advisors more capable, leading to better advice, stronger client connections, and ultimately, more successful financial results.

Streamline Financial Tasks with ChatGPT’s Master Prompt for Financial Advisors

As an expert in financial advising, I’m here to provide tailored guidance and insights to help you achieve your financial goals. Whether you’re planning for retirement, investing for the future, or managing your finances, I can offer personalized advice and strategies to optimize your financial well-being. To get started, please provide more information about your specific financial needs and objectives, as well as any concerns or challenges you may be facing. Here are some questions to help me understand your situation better:

What are your primary financial goals and objectives? Are you looking to build wealth, save for retirement, buy a home, or achieve other milestones? What is your current financial situation? Do you have any existing assets, debts, or investments? What is your risk tolerance? Are you comfortable with taking on higher levels of risk for potentially higher returns, or do you prefer a more conservative approach?

What is your investment timeframe? Are you investing for the short term, long term, or both? Do you have any specific financial concerns or challenges that you would like to address, such as managing debt, budgeting, or tax planning? What is your preferred method of communication for receiving financial advice? Do you prefer face-to-face meetings, phone calls, emails, or virtual consultations?

Have you worked with a financial advisor before? If so, what was your experience like, and what are you looking for in a financial advisor this time around? Are there any specific financial products or services you are interested in learning more about, such as retirement accounts, investment portfolios, insurance policies, or estate planning?

Do you have any ethical or socially responsible investment preferences that you would like to incorporate into your financial plan? What are your expectations for working with a financial advisor, and what would success look like for you in terms of achieving your financial goals?

Once I have a better understanding of your financial situation, goals, and preferences, I can provide personalized recommendations and strategies to help you make informed decisions and achieve financial success. Whether you’re just starting your financial journey or looking to optimize your existing financial plan, I’m here to support you every step of the way.

How to Use ChatGPT Prompts for Financial Advisors?

We’ve crafted highly optimized prompts for you, ensuring the best possible results. However, the effectiveness of these prompts depends on how efficiently you utilize them. Please refer to this resource for guidance on maximizing their impact and achieving your desired outcomes. How to Use These Prompts?

4 Dynamic ChatGPT Prompts for Financial Advisors to Provide Financial Guidance

Retirement Planning Guide

As a financial advisor, develop a comprehensive retirement planning guide tailored to clients nearing retirement age. Cover essential topics such as investment strategies, risk management, tax implications, and estate planning. Provide actionable steps and resources to help clients achieve their retirement goals while ensuring financial security in their golden years.

Investment Portfolio Optimization

Offer personalized advice on optimizing investment portfolios based on the client’s financial goals, risk tolerance, and time horizon. Discuss asset allocation strategies, diversification techniques, and investment opportunities across various asset classes. Provide insights on market trends, economic indicators, and risk factors to help clients make informed investment decisions.

Debt Management Strategies

Assist clients in developing effective debt management strategies to reduce debt burden and achieve financial stability. Offer guidance on prioritizing debt repayment, consolidating debts, and negotiating with creditors. Provide educational resources on budgeting, credit management, and debt consolidation options to empower clients to take control of their finances.

Financial Goal-Setting Workshop

Conduct a workshop on financial goal setting to help clients identify their short-term and long-term financial objectives. Guide clients in setting SMART (Specific, Measurable, Achievable, Relevant, Time-bound) goals, creating action plans, and tracking progress toward financial milestones. Offer support and accountability to motivate clients to achieve financial success.

57+ Impactful ChatGPT Prompts for Financial Advisors

ChatGPT Prompts for Investment Portfolio Management

- Design an investment portfolio tailored to a risk-averse client nearing retirement. Consider diversification strategies across asset classes and the inclusion of income-generating securities to ensure stability while aiming for moderate growth.

- You’ve been tasked with managing a portfolio for a young, aggressive investor with a high-risk tolerance. Craft an investment strategy that prioritizes high-growth opportunities, potentially leveraging options or alternative investments, while mitigating downside risks through active management and hedging techniques.

- Imagine you’re managing a socially responsible investment (SRI) portfolio for a group of environmentally conscious clients. Develop an investment approach that aligns with their values by integrating ESG (environmental, social, and governance) criteria into security selection and actively engaging with companies on sustainability initiatives. How would you balance financial returns with ethical considerations?

ChatGPT Prompts for Retirement Planning

- Create a comprehensive retirement plan for a couple aiming to retire in 20 years. Consider factors such as current savings, expected future income streams, lifestyle goals, inflation, and healthcare costs. Outline a strategy for asset allocation, savings contributions, and tax optimization to ensure a comfortable retirement.

- You’re advising a client who is nearing retirement age but hasn’t saved enough. Develop a personalized retirement roadmap that includes strategies for catching up on savings, potentially delaying retirement, maximizing Social Security benefits, and optimizing investment returns while managing risk. How can they still achieve their retirement goals despite starting late?

- Design a retirement income strategy for a recently retired individual looking to preserve their nest egg while generating a reliable income stream for the rest of their life. Explore options such as annuities, systematic withdrawal plans, dividend-paying investments, and bond laddering. How would you balance the need for income with the desire to leave a legacy for future generations?

ChatGPT Prompts for Tax Planning and Optimization

- Develop a tax-efficient investment strategy for a high-net-worth individual with significant taxable assets. Explore techniques such as tax-loss harvesting, asset location optimization, and strategic timing of capital gains realization to minimize the client’s tax burden while maximizing after-tax returns. How would you integrate tax considerations into their overall investment plan?

- You’re advising a small business owner on tax planning strategies to optimize their company’s tax position. Explore options such as choosing the right business structure, leveraging deductions and credits, implementing retirement plans, and utilizing tax-deferred investment vehicles. How can they legally minimize their tax liability while staying compliant with tax laws?

- Imagine you’re advising a family with complex estate planning needs. Design a tax-efficient estate plan that minimizes estate taxes, maximizes wealth transfer to heirs, and ensures the smooth transition of assets according to the client’s wishes. Consider strategies such as gifting, trusts, charitable giving, and life insurance. How would you navigate the intricate tax implications of their estate plan?

ChatGPT Prompts for Client Financial Education

- Develop a comprehensive financial education workshop series aimed at young adults entering the workforce for the first time. Cover topics such as budgeting, saving for emergencies, understanding credit and debt, basics of investing, and retirement planning. How can you tailor the content to resonate with this demographic and empower them to make sound financial decisions early in their careers?

- Create an interactive financial literacy program for high school students that covers key concepts such as budgeting, the importance of saving, managing debt, and the basics of investing. Incorporate real-life scenarios, games, and simulations to engage students and help them develop practical money management skills. How can you make financial education both informative and enjoyable for teenagers?

- Design a series of financial wellness seminars for employees of a large corporation. Topics may include understanding employee benefits, optimizing retirement contributions, managing work-life balance, and planning for major life events like buying a home or starting a family. How can you customize the content to address the specific financial challenges and goals of the company’s workforce?

Get Membership for More Prompts

ChatGPT Prompts for Asset Allocation Strategies

- Compare and contrast different asset allocation strategies, such as strategic, tactical, and dynamic asset allocation. Discuss the benefits and drawbacks of each approach, as well as the suitability for different investor profiles and market conditions. Provide examples of how these strategies can be implemented in a portfolio.

- Explore the role of asset allocation in risk management and portfolio diversification. Discuss the importance of spreading investments across asset classes such as stocks, bonds, real estate, and commodities to reduce overall portfolio risk. Illustrate how asset allocation can help investors achieve their financial goals while balancing risk and return.

- Investigate the impact of age and investment horizon on asset allocation decisions. Discuss how asset allocation should evolve as investors move through different life stages, from accumulation to preservation of wealth. Explore strategies for adjusting asset allocation as retirement approaches to ensure a sustainable income stream while managing longevity risk.

ChatGPT Prompts for Sustainable and Responsible Investing (SRI)

- Examine the principles and strategies behind Sustainable and Responsible Investing (SRI). Discuss how SRI integrates environmental, social, and governance (ESG) factors into investment decision-making to generate positive social and environmental impacts alongside financial returns. Explore the various approaches to SRI, including exclusionary screening, ESG integration, impact investing, and shareholder advocacy.

- Investigate the performance and impact of Sustainable and Responsible Investing (SRI) strategies on investment portfolios. Analyze empirical studies and case studies to evaluate the financial performance of SRI funds compared to traditional investment approaches. Discuss the potential benefits of SRI in terms of risk mitigation, long-term value creation, and alignment with investor values and preferences.

- Explore the challenges and opportunities in implementing Sustainable and Responsible Investing (SRI) strategies in today’s financial markets. Discuss issues such as data availability and quality, standardization of ESG metrics, greenwashing, and the trade-offs between financial returns and social/environmental impact. Consider how investors can navigate these challenges and incorporate SRI principles into their investment decision-making process.

ChatGPT Prompts for Financial Goal Setting and Tracking

- Develop a step-by-step guide for setting and tracking financial goals. Explore the importance of setting specific, measurable, achievable, relevant, and time-bound (SMART) goals, and discuss different types of financial goals, such as saving for retirement, buying a home, or paying off debt. Provide tools and techniques for tracking progress, adjusting goals as needed, and celebrating milestones along the way.

- Examine the role of financial goal setting in creating a roadmap for long-term financial success. Discuss how to prioritize goals based on their importance, urgency, and feasibility, and explore strategies for breaking down larger goals into smaller, manageable milestones. Illustrate how tracking progress regularly can help individuals stay motivated and on track to achieve their financial objectives.

- Explore the psychological and behavioral aspects of financial goal setting and tracking. Discuss common challenges and pitfalls that individuals may encounter, such as procrastination, impulsivity, and loss aversion, and explore strategies for overcoming these barriers. Consider the role of accountability partners, financial planners, and technology tools in helping individuals stay focused and disciplined in pursuing their financial goals.

ChatGPT Prompt for Crisis Management and Contingency Planning

- Examine the role of contingency planning in personal finance and wealth management. Discuss common financial crises individuals may face, such as job loss, medical emergencies, or market downturns, and explore strategies for building financial resilience. Discuss the importance of emergency funds, insurance coverage, and flexible budgeting in preparing for unforeseen events and mitigating their impact on financial stability.

ChatGPT Prompts for Financial Advisors PDF Download

Get your complimentary copy of ChatGPT Prompts for Financial Advisors today. Grasp the chance to enhance your work productivity effortlessly. Secure your copy now and propel your ability to distill information to new heights.

Other ChatGPT Prompts for Financial Advisors

Prioritizing Financial Goals

- Guide clients in prioritizing their financial goals, [input considering retirement savings, education funding, or debt reduction], to create a roadmap for a secure financial future.

Assessing Risk Tolerance

- Help clients assess their risk tolerance and investment preferences, [input considering factors like age, income stability, and long-term goals], to develop suitable investment strategies.

Customizing Investment Portfolios

- Design personalized investment portfolios tailored to clients’ risk tolerance, time horizon, and financial objectives, [input including asset allocation and diversification strategies].

Retirement Planning Consultation

- Provide comprehensive retirement planning services, [input covering retirement age, income sources, and lifestyle expectations], to help clients achieve their retirement goals.

Tax Optimization Strategies

- Develop tax-efficient investment and estate planning strategies, [input including tax-deferred accounts, deductions, and credits], to minimize clients’ tax liabilities.

Estate Planning Guidance

- Offer guidance on estate planning and wealth transfer strategies, [input covering wills, trusts, and beneficiary designations], to preserve and transfer assets according to clients’ wishes.

Debt Management Solutions

- Create strategies to manage and reduce clients’ debt burden, [input including debt consolidation, repayment plans, and budgeting techniques], to improve their financial health.

Insurance Needs Analysis

- Conduct a thorough analysis of clients’ insurance coverage, [input considering life, health, disability, and long-term care insurance], to ensure adequate protection against unexpected events.

Education Funding Options

- Explore various education funding options, [input such as 529 plans, Coverdell accounts, or custodial accounts], to help clients save for their children’s education expenses.

Cash Flow Optimization

- Assist clients in optimizing their cash flow and budgeting, [input including expense tracking, debt management, and emergency fund planning], to achieve their financial goals.

Charitable Giving Strategies

- Develop charitable giving strategies aligned with clients’ philanthropic goals and tax planning objectives, [input including donor-advised funds, charitable trusts, and direct donations].

Socially Responsible Investing (SRI)

- Introduce socially responsible investing options, [input considering clients’ values and environmental, social, and governance (ESG) criteria], to align their investments with their ethical beliefs.

Retirement Income Planning

- Create a comprehensive retirement income plan, [input including strategies for maximizing Social Security benefits, pension distributions, and investment withdrawals], to sustain clients’ lifestyle in retirement.

Long-Term Care Planning

- Assist clients in planning for long-term care needs, [input including insurance options, self-funding strategies, and Medicaid planning], to protect their assets and ensure quality care.

Financial Education Workshops

- Host educational workshops on various financial topics, [input including retirement planning, investment fundamentals, and tax strategies], to empower clients with financial knowledge.

Market Insights and Updates

- Provide clients with timely market insights and updates, [input including economic trends, investment opportunities, and risk management strategies], to keep them informed and engaged.

Investment Policy Statement (IPS) Development

- Collaborate with clients to develop a customized investment policy statement, [input outlining investment objectives, risk tolerance, asset allocation, and performance benchmarks].

Behavioral Finance Coaching

- Offer guidance on behavioral finance principles, [input including investor biases, emotional decision-making, and goal-based investing], to help clients overcome common investing pitfalls.

Retirement Plan Rollovers

- Assist clients in rolling over retirement accounts, [input such as 401(k) plans, 403(b) plans, and IRAs], to ensure seamless transitions and optimize investment options.

Regular Portfolio Reviews

- Conduct periodic portfolio reviews and performance evaluations, [input including rebalancing, tax-loss harvesting, and investment strategy adjustments], to keep clients’ portfolios aligned with their goals.

Wealth Preservation Strategies

- Develop personalized wealth preservation strategies, [input considering asset protection, tax minimization, and risk management], to safeguard clients’ financial legacies.

Retirement Income Distribution Planning

- Assist clients in structuring tax-efficient retirement income distributions, [input considering Social Security optimization, annuity options, and systematic withdrawals], to ensure sustainable income throughout retirement.

Health Care Cost Planning

- Guide clients in planning for future health care costs, [input including Medicare enrollment, supplemental insurance options, and long-term care considerations], to avoid financial strain in retirement.

Portfolio Stress Testing

- Conduct stress tests on clients’ investment portfolios, [input considering various market scenarios and economic downturns], to assess resilience and mitigate potential risks.

Behavioral Coaching for Market Volatility

- Provide behavioral coaching to help clients navigate market volatility and stay focused on their long-term financial goals, [input including risk tolerance reassessment and disciplined investment strategies].

Sell Your Prompts Here

Are you good at writing prompts?

Put your expertise on display here and get paid!

Philanthropic Legacy Planning

- Facilitate discussions on philanthropic legacy planning, [input considering charitable giving vehicles, family foundations, and impact investing], to fulfill clients’ charitable objectives and leave a lasting impact.

Tax-Efficient Wealth Transfer

- Implement tax-efficient wealth transfer strategies, [input including gifting strategies, trusts, and estate freeze techniques], to minimize estate taxes and maximize wealth transfer to future generations.

Financial Planning for Business Owners

- Offer comprehensive financial planning services tailored to the unique needs of business owners, [input including business succession planning, executive compensation strategies, and liquidity events].

Social Security Optimization

- Optimize Social Security claiming strategies, [input considering factors like claiming age, spousal benefits, and survivor benefits], to maximize lifetime benefits for clients and their spouses.

Investment Due Diligence

- Conduct thorough due diligence on investment opportunities, [input considering investment objectives, risk profiles, and alignment with clients’ investment policy statements], to ensure suitability and alignment with clients’ goals.

Family Financial Education

- Facilitate family financial education sessions, [input focusing on financial literacy, budgeting skills, and generational wealth transfer], to empower clients’ children and heirs with financial knowledge.

Tax-Efficient Charitable Giving

- Develop tax-efficient charitable giving strategies, [input considering donor-advised funds, charitable remainder trusts, and charitable gift annuities], to maximize the impact of clients’ charitable donations.

Retirement Lifestyle Planning

- Assist clients in envisioning their desired retirement lifestyle, [input considering travel plans, hobbies, and social activities], to create a comprehensive retirement spending plan aligned with their aspirations.

Investment Policy Statement Review

- Review and update clients’ investment policy statements, [input considering changes in financial goals, risk tolerance, and market conditions], to ensure ongoing alignment with their investment objectives.

Financial Planning for Divorcees

- Provide specialized financial planning services for clients going through divorce, [input including asset division, alimony considerations, and post-divorce financial planning], to help them navigate the transition with confidence.

Sustainable Investing Solutions

- Offer sustainable investing solutions aligned with client’s environmental, social, and governance (ESG) criteria, [input including impact investing funds, green bonds, and shareholder advocacy strategies].

Health Savings Account (HSA) Planning

- Optimize clients’ use of health savings accounts (HSAs) for long-term retirement planning, [input including HSA contributions, investment strategies, and tax-free withdrawals for qualified medical expenses].

College Funding Strategies

- Develop comprehensive college funding strategies for clients’ children or grandchildren, [input considering 529 plans, education savings accounts, and financial aid optimization], to ease the burden of college expenses.

Get a Complete List Here

Access 57+ ChatGPT Prompts for Financial Advisors

Final Thoughts

In conclusion, ChatGPT Prompts for Financial Advisors offers a streamlined solution for busy professionals navigating the complexities of financial analysis. With tailored prompts at their fingertips, users can save time and energy while optimizing their workflow. Take the first step towards efficiency and success. Happy Finances!