155 Impactful ChatGPT Prompts for Insurance Agents – Fueling Excellence in Insurance

In the dynamic world of insurance, staying ahead means having the right tools at your disposal. That’s where the power of AI-driven assistance comes into play. With the rise of digital technology, insurance agents are discovering a game-changing ally ChatGPT.These intelligent prompts, tailored for insurance agents, open a world of tailored insights and expert guidance, enhancing client interactions from lead generation to policy review. Curious to explore the best ChatGPT Prompts for Insurance Agents and witness firsthand how they can transform your client relationships and streamline your processes? Dive into our compilation of effective prompts that bring you exactly what you need, exactly when you need it.

Navigating Insurance Dynamics – Facing the Challenge

In the complex realm of insurance, agents often find themselves grappling with the need for precise information that aligns seamlessly with their client’s requirements. Crafting tailored communications and recommendations while handling various stages of insurance interactions can be a daunting task. That’s where ChatGPT Prompts for Insurance Agents come to the rescue, providing a solution that not only streamlines processes but also helps agents deliver personalized and impactful interactions.

Meeting Expectations with Ease – Delivering Tailored Insights

Readers can expect a seamless transition from uncertainty to empowerment as they explore the curated compilation of [ChatGPT Prompts for Insurance Agents]. By gaining access to expert-generated prompts, insurance agents will unlock a treasure trove of solutions tailored to their exact needs. This resource promises to transform their approach, helping them establish stronger client relationships and navigate the insurance landscape with confidence.

Why Are ChatGPT Prompts Vital for Enhancing Insurance Agent Performance?

In today’s insurance landscape, where every interaction counts, having the right tools can make all the difference. Enter [ChatGPT Prompts for Insurance Agents], a game-changing resource that empowers agents to tailor their conversations and solutions with precision. Imagine offering clients recommendations that resonate on a personal level, ensuring their families’ security and financial well-being. With the potential to improve profit margins, client satisfaction, and overall efficiency, embracing these prompts isn’t just an option—it’s a strategic move for success in the insurance realm.

Benefits of Insurance

1. Financial Protection: Insurance provides a safety net against unexpected events, helping individuals and families manage the financial burden of accidents, illnesses, or property damage.

2. Peace of Mind: Having insurance offers peace of mind, knowing that you’re prepared for the uncertainties of life and that you won’t be left financially devastated in case of a crisis.

3. Risk Mitigation: Insurance helps mitigate risks by transferring potential losses to an insurance company. This is particularly important for businesses, as it allows them to operate without the fear of major financial setbacks.

4. Legal and Contractual Requirements: Many aspects of life, such as owning a car or a home, require insurance as a legal or contractual requirement. Insurance ensures compliance with these obligations.

5. Economic Stability: Insurance plays a role in stabilizing the economy by reducing the financial impact of widespread disasters and enabling individuals and businesses to recover more quickly.

Prompts for Professionals

Single Master ChatGPT Prompt for Insurance Agents

I’m seeking comprehensive guidance for [Client Name]’s insurance needs across multiple stages. Please provide detailed assistance for tasks including initial consultation, needs assessment, tailored product recommendations, lead generation strategies, engaging initial contact, thorough needs assessment process, crafting effective proposals and presentations, accurate quoting and pricing, the smooth application process, navigating underwriting and approval, managing policy issuance and payment, thorough policy review and updates, efficient claims assistance, and effective client relationship management. Your guidance will help me provide [Client Name] with the best insurance solutions, from understanding their needs to policy issuance, renewals, claims processing, and maintaining a strong client-agent relationship.

Note: Replace Placeholders With Specific Information

ChatGPT Prompts for Insurance Agents

1. Creating a Comprehensive Insurance Proposal for Client Name:

“I’m creating a comprehensive insurance proposal for [Client Name]. Can you guide me on [policy options/coverage recommendations] to address their [specific needs/life stage] and provide them with a well-rounded insurance solution?”

2. Assisting Client Name with the Claims Process for Type of Insurance:

“I’m assisting [Client Name] with the claims process for their [type of insurance] policy. Could you provide a step-by-step breakdown of how to [initiate/fill out] a claim form and navigate the [assessment/payout] stages?”

3. Conducting an Annual Policy Review for Client Name’s Type of Insurance:

“I’m conducting an annual policy review for [Client Name]’s [type of insurance] coverage. Can you guide me on how to [analyze/update] their [coverage/limits] based on their [changing needs/claims history]?”

4. Explaining Client Name’s Premium Increase for Type of Insurance:

“I need to explain a premium increase to [Client Name] for their [type of insurance] policy. Could you assist me in clarifying the [factors/causes] contributing to the increase and providing options to [manage/reduce] costs?”

5. Guiding Client Name Through Type of Insurance Application Process:

“I’m guiding [Client Name] through the application process for [type of insurance]. Can you help me provide [step-by-step guidance/document requirements] to ensure a smooth and successful application?”

Note: Feel free to insert specific information in the placeholders provided to receive detailed assistance for your insurance-related tasks.

1. Training and Licensing

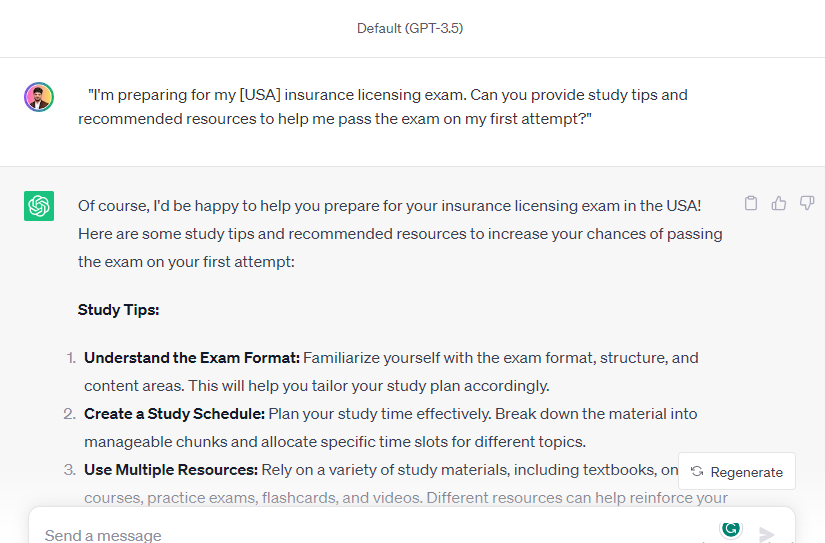

1. Licensing Exam Preparation:

“I’m preparing for my [state] insurance licensing exam. Can you provide study tips and recommended resources to help me pass the exam on my first attempt?”

2. State-Specific Requirements:

“What are the [state] requirements for obtaining an insurance agent license? I need information about pre-licensing education, exam format, and any additional prerequisites.”

3. Study Material Recommendations:

“I’m looking for the best study materials to prepare for my insurance licensing exam. Could you suggest reputable textbooks, online courses, or practice exams that align with the [type of insurance] licensing requirements?”

4. License Renewal Process:

“My insurance agent license in [state] is expiring soon. What steps do I need to take to renew it? Are there any continuing education requirements that I should be aware of?”

5. Multiple Lines of Insurance:

“I’m interested in selling multiple lines of insurance, such as life, health, and property. Could you guide me through the licensing process for each of these lines in [state], including any differences in requirements?”

6. Reciprocity and Non-Resident Licensing:

“I currently hold an insurance license in [state] and want to expand my business to [another state]. What’s the process for obtaining a non-resident license in [another state], and are there any reciprocity agreements that could benefit me?”

7. Specialized License Endorsements:

“I’ve heard about specialized license endorsements for niches like long-term care insurance or annuities. How do I go about adding these endorsements to my existing insurance license in [state]?”

8. Pre-Licensing Course Selection:

“I’m considering enrolling in a pre-licensing course for [type of insurance] in [state]. Can you recommend accredited course providers and outline the topics that I should focus on during the training?”

9. Exam Application Process:

“I’m ready to apply for the insurance licensing exam in [state]. Could you walk me through the application process, including deadlines, required documents, and any fees involved?”

10. License Categories and Designations:

“I’m curious about the different license categories and designations available for insurance agents in [state]. How do these categories impact the types of policies I can sell, and how should I choose the most suitable one for my career goals?”

Note: Feel free to insert your specific details into the placeholders, and I’ll be here to provide comprehensive information and assistance based on the provided prompts.

2. Product Knowledge

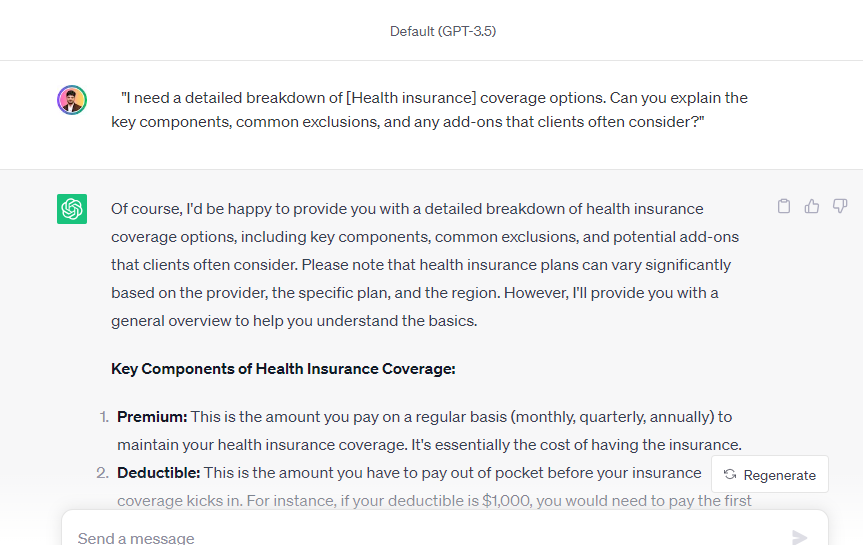

1. Understanding Type of Insurance Coverage:

“I need a detailed breakdown of [type of insurance] coverage options. Can you explain the key components, common exclusions, and any add-ons that clients often consider?”

2. Comparing Company Name Policies:

“I’m selling insurance policies from [Company Name]. Could you provide a comparison of their [type of insurance] policies, highlighting the differences in coverage, premiums, and customer reviews?”

3. Explaining Deductibles and Premiums:

“Clients often ask about how deductibles affect premiums. Can you clarify the relationship between deductibles and premiums for [type of insurance] policies?”

4. Navigating Type of Insurance Regulations:

“I’m encountering questions about the regulatory landscape for [type of insurance] in [state]. Can you outline the relevant regulations, licensing requirements, and consumer protection laws?”

5. Addressing Policy Limits and Payouts:

“I need help explaining policy limits and potential payouts to clients interested in [type of insurance]. Could you provide examples of scenarios and how coverage limits come into play?”

6. Understanding Type of Insurance Riders:

“Clients are curious about riders for their [type of insurance] policies. Can you provide an overview of common riders, such as waiver of premium or accidental death, and their benefits?”

7. Exploring Type of Insurance for Different Life Stages:

“I want to understand how [type of insurance] policies adapt to clients’ changing needs. Can you elaborate on how these policies cater to individuals at different life stages, from young professionals to retirees?”

8. Analyzing Type of Insurance Market Trends:

“I’m looking to stay updated on [type of insurance] market trends. Can you provide insights into current trends, emerging technologies, and customer preferences in this sector?”

9. Comparing Type of Insurance vs. Other Type of Insurance:

“Clients often ask me about the differences between [type of insurance] and [other type of insurance]. Can you provide a comprehensive comparison, outlining the advantages and limitations of each?”

10. Explaining Type of Insurance Underwriting Process:

“I need to explain the underwriting process for [type of insurance] policies to my clients. Could you break down the steps involved, from application submission to policy approval or adjustments?”

Note: Replace the placeholders with the specific details relevant to your inquiries, and I’ll provide comprehensive information and insights based on the provided prompts.

3. Lead Generation

1. Effective Networking Strategies:

“I’m looking to expand my client base. Could you suggest effective networking strategies within the [industry/conference/community] that could help me connect with potential clients?”

2. Referral Generation Tips:

“I want to maximize referrals from my existing clients. Can you provide tips on how to encourage referrals and create a referral rewards program that resonates with my [client base]?”

3. Online Marketing Approach:

“I’m interested in leveraging online platforms to generate leads. Could you guide me on creating a compelling [social media/email marketing/website] strategy that attracts leads in the [target demographic]?”

4. Cold Calling Effectiveness:

“I’m considering cold calling as part of my lead generation efforts. Can you provide script suggestions and techniques to ensure my cold calls are engaging and effective?”

5. Engaging Content Creation:

“I want to establish myself as an authority in [insurance niche] and attract leads through valuable content. How can I create [blog posts/webinars/infographics] that resonate with my [target audience]?”

6. Attending Community Events:

“I’m planning to attend local community events. Could you advise on how to make the most of these events to engage with potential leads and distribute [brochures/business cards] effectively?”

7. Partnering with Businesses:

“I’m interested in partnering with local businesses for lead generation. What are some strategic ways to collaborate with [business type] to tap into their customer base and offer mutual benefits?”

8. Optimizing Online Advertising:

“I’m considering running online ads for lead generation. Can you help me optimize my [Google Ads/Facebook Ads/LinkedIn Ads] campaigns to reach my [target audience] effectively?”

9. Engaging Social Media Content:

“I need ideas for creating engaging social media content that attracts leads. Can you suggest [interactive polls/insightful videos/testimonials] that resonate with my [target demographic]?”

10. Leveraging Webinars or Workshops:

“I’m thinking of hosting webinars or workshops to generate leads. How can I structure compelling [webinar/workshop] content that educates participants and positions me as a knowledgeable [insurance professional]?”

Note: Feel free to use these prompts and insert specific information in the placeholders provided. I’ll then provide you with comprehensive and detailed information to help with your lead generation efforts.

4. Initial Contact

1. Crafting a Compelling Outreach Email:

“I’m reaching out to potential clients via email. Can you help me draft an engaging [subject line/introduction/body] that captures their attention and encourages them to learn more about [insurance type]?”

2. Effective Phone Script for Cold Calls:

“I’m making cold calls to potential clients. Could you provide me with a well-structured phone script that establishes rapport, introduces my [insurance services], and generates interest?”

3. Engaging Social Media Direct Message:

“I want to initiate conversations with potential clients on social media. Can you help me compose a [friendly introduction/mention of mutual interest] that encourages them to explore [insurance type] options?”

4. Networking Event Introduction:

“I’ll be attending a networking event. Could you suggest an [elevator pitch/introduction line] that effectively conveys my expertise and the value of my [insurance services] to fellow attendees?”

5. Approaching Referral Prospects:

“I’m reaching out to referrals provided by existing clients. Can you help me craft a [warm introduction/acknowledgment of the referral] that encourages a smooth initial conversation?”

6. Email Outreach to Warm Leads:

“I have a list of warm leads to contact. Could you assist me in creating an email that references [shared connection/past interaction] and encourages them to explore [insurance type] solutions?”

7. Connecting on Social Media Platforms:

“I’m connecting with potential clients on [LinkedIn/Facebook/Instagram]. Can you help me personalize [connection request/initial message] to convey my [insurance expertise] and generate interest?”

8. Engaging Opening Line in Networking:

“I’ll be meeting potential clients at a networking event. Could you provide me with an engaging [opening line/icebreaker] that sparks conversations about their insurance needs?”

9. Follow-up Email after Initial Contact:

“I’ve made initial contact, and I want to send a follow-up email. Can you help me draft a [thank-you note/invitation to learn more] that keeps the conversation moving forward?”

10. Introducing Insurance Services via LinkedIn:

“I’m using LinkedIn to connect with potential clients. Can you help me write an [introductory message/LinkedIn connection request] that highlights my expertise in [insurance type] and prompts them to engage?”

Note: Feel free to use these prompts and insert specific information in the placeholders provided. I’ll then provide you with comprehensive and detailed assistance for making effective initial contacts with potential clients.

5. Needs Assessment

1. Gathering Client Name’s Insurance Goals:

“I’m meeting with [Client Name] to assess their insurance needs. Can you provide a list of [open-ended questions/probing inquiries] to understand their goals and expectations?”

2. Determining Client Name’s Current Coverage:

“I need to evaluate [Client Name]’s existing insurance coverage. Could you help me create a checklist to gather information about their [current policies/coverage limits]?”

3. Analyzing Client Name’s Financial Situation:

“To provide suitable recommendations, I need to understand [Client Name]’s financial situation. What [income/assets/liabilities] information should I gather during the needs assessment?”

4. Assessing Client Name’s Risk Tolerance:

“I want to gauge [Client Name]’s risk tolerance for insurance purposes. Can you suggest questions that explore their comfort level with [deductibles/risk exposure]?”

5. Identifying Client Name’s Life Stage Needs:

“I’m working with [Client Name] and need to identify their insurance needs based on their life stage. Could you provide a questionnaire to determine their [family situation/financial goals]?”

6. Addressing Client Name’s Concerns:

“I want to ensure I address [Client Name]’s specific concerns during the assessment. What are some common [worries/questions] I should include in the conversation?”

7. Understanding Client Name’s Health Considerations:

“I need to factor in [Client Name]’s health considerations when recommending insurance options. Can you help me create a list of [health conditions/medical history] questions?”

8. Assessing Client Name’s Long-Term Goals:

“I’d like to explore [Client Name]’s long-term goals during the assessment. What [retirement plans/legacy desires] questions should I ask to tailor my recommendations?”

9. Uncovering Client Name’s Budget Constraints:

“To ensure affordability, I need to understand [Client Name]’s budget constraints. What [monthly expenses/financial commitments] questions can I ask to determine their limits?”

10. Considering Client Name’s Future Plans:

“I want to account for [Client Name]’s future plans in the assessment. Could you provide me with a list of [career changes/property acquisitions] questions to guide the conversation?”

Note: Feel free to use these prompts and insert specific information in the placeholders provided. I’ll then provide you with comprehensive and detailed assistance for conducting effective needs assessments with potential clients.

6. Proposal and Presentation

1. Crafting a Comprehensive Proposal:

“I need to create a comprehensive proposal for [Client Name]’s [type of insurance] coverage. Can you guide me on structuring the proposal with sections for [coverage options/explanations/pricing]?”

2. Presenting Company Name’s Unique Benefits:

“I want to highlight the unique benefits of [Company Name]’s insurance policies. Could you assist me in creating a presentation slide that outlines [key features/advantages] for potential clients?”

3. Customizing Proposal for Client Name:

“I’m tailoring a proposal for [Client Name]’s specific needs. Can you help me draft personalized [cover letter/introduction] content that resonates with their [insurance goals/situation]?”

4. Visualizing Coverage Options:

“I need to visually represent different coverage options for [Client Name]. Could you assist me in creating [comparison charts/infographics] that illustrate the benefits of each option?”

5. Addressing Client Name’s Concerns:

“I want to address [Client Name]’s specific concerns in the proposal. Can you help me draft [customized explanations/solutions] to ease any hesitations they might have?”

6. Calculating Premiums and Costs:

“I need to provide accurate premium calculations for [Client Name]’s insurance proposal. Could you guide me on calculating [monthly/yearly] premiums based on their [coverage selections/deductibles]?”

7. Visualizing Long-Term Value:

“I want to showcase the long-term value of [type of insurance] to potential clients. Can you help me create a [projections graph/illustrative chart] that demonstrates the financial benefits over time?”

8. Comparing Coverage Packages:

“I need to compare different coverage packages for [Client Name]. Could you assist me in creating a side-by-side [benefits/coverage limits] comparison that’s easy to understand?”

9. Addressing Policy Questions:

“I want to preemptively address potential questions in the proposal. Can you help me include an [FAQ section/additional resources] that provides clarity on common [policy terms/claims process]?”

10. Showcasing Client Testimonials:

“I’m looking to incorporate client testimonials in my presentation. Could you help me select and format [testimonial quotes/endorsements] that highlight the positive experiences of satisfied clients?”

Note: Feel free to use these prompts and insert specific information in the placeholders provided. I’ll then provide you with comprehensive and detailed assistance for creating compelling proposals and presentations for your clients.

7. Quoting and Pricing

1. Calculating Premiums for Client Name:

“I need assistance in calculating the premiums for [Client Name]’s [type of insurance] coverage. Could you guide me through the process of determining [coverage selections/deductibles] and providing an accurate premium estimate?”

2. Presenting Pricing Options:

“I’m preparing to present pricing options to [Client Name]. Can you help me create a clear breakdown of [basic coverage/enhanced coverage] with associated [monthly/yearly] premium costs?”

3. Tailoring Quotes to Client Name’s Budget:

“I want to tailor insurance quotes to fit within [Client Name]’s budget. Could you provide strategies for adjusting [coverage levels/deductibles] to align with their financial constraints?”

4. Explaining Factors Affecting Premiums:

“I need to explain to [Client Name] why their premium is calculated as it is. Can you assist me in breaking down the [risk factors/coverage elements] that contribute to their quoted price?”

5. Comparing Premiums with Deductibles:

“I want to show [Client Name] the relationship between premiums and deductibles. Can you help me create a [visual graph/table] that illustrates how adjusting deductibles impacts their premiums?”

6. Discounts and Savings Explanation:

“I need to explain the available discounts and potential savings to [Client Name]. Could you assist me in outlining the [bundle discount/loyalty discount] options and their impact on the overall cost?”

7. Demonstrating Value for Price:

“I want to highlight the value of the insurance coverage in relation to the price for [Client Name]. Can you help me create a persuasive [value proposition/ROI comparison] to justify the premium?”

8. Handling Price Comparison Queries:

“I’m expecting questions about how our pricing compares to competitors. Can you guide me in articulating [unique features/value-added services] that make our pricing competitive?”

9. Explaining Price Fluctuations:

“I need to explain to [Client Name] why their premium may have changed. Can you help me outline [policy adjustments/external factors] that can impact the premium over time?”

10. Providing Transparent Billing Details:

“I want to provide [Client Name] with transparent billing details for their chosen coverage. Can you help me outline the [payment schedule/cancellation policy] and clarify any potential additional charges?”

Note: Feel free to use these prompts and insert specific information in the placeholders provided. I’ll then provide you with comprehensive and detailed assistance for effectively quoting and pricing insurance policies for your clients.

8. Application Process

1. Completing Client Name’s Application Form:

“I’m assisting [Client Name] in completing the application form for [type of insurance]. Can you guide me through the process of gathering the required [personal information/coverage selections]?”

2. Ensuring Accuracy in Application Details:

“I want to ensure the application submitted by [Client Name] is accurate. Could you provide a checklist of [required documents/accurate information] to verify before submitting?”

3. Guidance on Medical History Disclosure:

“I need to advise Client Name on disclosing their medical history accurately. Can you help me create a [sensitive communication/FAQ section] that addresses their concerns?”

4. Explaining Type of Insurance Application Timeline:

“I’m clarifying the application timeline for [Client Name]’s [type of insurance] policy. Could you provide a breakdown of the [application submission/review/approval] stages and their estimated durations?”

5. Document Submission for Type of Insurance:

“I need to guide [Client Name] on submitting relevant documents for their [type of insurance] application. Can you help me create a [document checklist/secure upload instructions] for them?”

6. Application Follow-Up and Communication:

“I want to ensure a smooth communication flow during the application process. Could you assist me in crafting [follow-up emails/status update messages] for [Client Name] to keep them informed?”

7. Addressing Client Name’s Concerns About Privacy:

“I’m addressing [Client Name]’s concerns about the privacy of their application data. Can you help me explain the [data protection measures/encryption processes] that ensure their information remains secure?”

8. Preparing Client Name for Underwriting Stage:

“I need to prepare [Client Name] for the underwriting stage of their application. Can you help me provide [underwriting overview/common underwriting requirements] to set their expectations?”

9. Explaining Electronic Signature Process:

“I’m guiding [Client Name] through the electronic signature process. Could you help me create a [step-by-step guide/explanation video] that walks them through the process?”

10. Offering Application Assistance for Type of Insurance Riders:

“I want to assist [Client Name] with adding riders to their [type of insurance] policy application. Can you provide guidance on how to choose [relevant riders/benefits] and complete the process?”

Note: Feel free to use these prompts and insert specific information in the placeholders provided. I’ll then provide you with comprehensive and detailed assistance for guiding clients through the insurance application process.

9. Underwriting and Approval

Certainly, here are 10 ChatGPT prompts for insurance agents seeking help with the underwriting and approval process, with placeholders used only in the prompts:

1. Preparing Client Name’s Application for Underwriting:

“I’m preparing to submit [Client Name]’s application for underwriting. Can you guide me on [necessary documentation/medical history disclosure] to ensure a smooth underwriting process?”

2. Anticipating Underwriting Questions from Client Name:

“I want to anticipate and address potential questions from [Client Name] about the underwriting process. Could you help me create a [FAQ section/informational guide] that explains [underwriting criteria/reasons for medical questions]?”

3. Managing Client Name’s Expectations for Approval Timeline:

“I’m explaining the approval timeline to [Client Name]. Can you assist me in providing [average approval duration/possible factors affecting timeline] to set their expectations?”

4. Handling Additional Information Requests from Underwriters:

“I’ve received additional information requests from underwriters regarding [Client Name]’s application. Can you help me gather [specific documents/clarifications] to satisfy these requests?”

5. Addressing Client Name’s Concerns About Underwriting Factors:

“I’m addressing [Client Name]’s concerns about how certain factors affect their underwriting. Can you guide me in explaining [impact of medical history/risk assessment] to ease their worries?”

6. Navigating Underwriting for Type of Insurance Riders:

“I’m assisting [Client Name] with adding riders to their [type of insurance] policy. Could you provide insights on how the underwriting process works for [specific riders/additional benefits]?”

7. Explaining Client Name’s Role During Underwriting:

“I need to explain [Client Name]’s role in the underwriting process. Can you help me outline how their [honesty/cooperation] during underwriting can impact the approval outcome?”

8. Preparing Client Name for Medical Examinations:

“I’m preparing [Client Name] for the required medical examinations during underwriting. Could you assist me in providing [preparation tips/overview of examination procedures] to ease their concerns?”

9. Guidance on Addressing Underwriter Queries:

“I want to respond effectively to queries from underwriters regarding [Client Name]’s application. Can you help me draft [clear explanations/supporting documentation] to address their questions?”

10. Explaining the Approval Process After Underwriting:

“I need to explain the approval process to [Client Name] once underwriting is complete. Could you help me outline the steps from [underwriter review/decision communication] to final policy issuance?”

Note: Feel free to use these prompts and insert specific information in the placeholders provided. I’ll then provide you with comprehensive and detailed assistance for navigating the underwriting and approval process effectively.

10. Policy Issuance and Payment

1. Issuing Client Name’s Policy After Approval:

“I’m preparing to issue [Client Name]’s approved policy. Could you guide me on the steps to [generate the policy document/prepare the policy package] for delivery?”

2. Explaining Policy Details to Client Name:

“I want to explain the details of [Client Name]’s policy. Can you help me create a [policy overview/highlights document] that outlines their [coverage terms/endorsements]?”

3. Setting Up Payment for Client Name’s Policy:

“I need to assist [Client Name] in setting up payment for their policy. Could you provide guidance on [payment methods/frequency] and ensure they understand the [premium amount/due dates]?”

4. Providing Client Name with Payment Options:

“I want to present [Client Name] with different payment options. Can you help me create a comparison of [annual/semi-annual/monthly] payment plans with associated [discounts/fees]?”

5. Explaining the Grace Period and Lapse Policy:

“I need to clarify the grace period and potential policy lapse to [Client Name]. Could you assist me in creating an [explanation/FAQ section] that outlines the consequences of missed payments?”

6. Guiding Client Name on Policy Delivery:

“I’m guiding [Client Name] on how they will receive their policy documents. Can you help me explain [electronic delivery/mail delivery] options and ensure they know what to expect?”

7. Addressing Client Name’s Payment Concerns:

“I want to address [Client Name]’s concerns about the payment process. Can you guide me in explaining [autopay options/payment confirmation process] to alleviate their worries?”

8. Customizing Payment Schedule for Client Name:

“I’m customizing the payment schedule for [Client Name]’s convenience. Could you help me adjust the [due dates/payment amounts] to match their [financial situation/preferred timing]?”

9. Offering Assistance with Payment Methods:

“I’m helping [Client Name] choose a suitable payment method. Can you provide insights into [bank transfers/credit card payments] and guide me on facilitating the setup?”

10. Explaining Renewal Payment Process to Client Name:

“I need to explain the renewal payment process to [Client Name]. Could you assist me in outlining the [upcoming renewal/automatic renewal] steps and potential changes in premiums?”

Note: Feel free to use these prompts and insert specific information in the placeholders provided. I’ll then provide you with comprehensive and detailed assistance for effectively managing policy issuance and payment processes for your clients.

11. Policy Review

1. Scheduling Client Name’s Annual Policy Review:

“I’m scheduling [Client Name]’s annual policy review. Could you guide me on [recommended timing/document preparation] for conducting a thorough review of their [type of insurance] coverage?”

2. Explaining Policy Changes to Client Name:

“I need to explain recent policy changes to [Client Name]. Can you help me create a [clear summary/detailed breakdown] of the changes and their impact on their [coverage/premiums]?”

3. Analyzing Client Name’s Evolving Needs:

“I want to analyze how [Client Name]’s insurance needs have evolved since their last review. Could you assist me in creating [needs assessment/comparison with life stage] to tailor our recommendations?”

4. Guiding Client Name on Adjustments:

“I’m guiding [Client Name] on potential adjustments to their coverage. Can you help me explain the [benefits/drawbacks] of [increasing/reducing] their [coverage limits/deductibles]?”

5. Reviewing Premium Changes with Client Name:

“I need to review premium changes with [Client Name]. Could you guide me on providing [clear explanations/comparative analysis] of how [external factors/coverage adjustments] have influenced their premiums?”

6. Addressing Client Name’s Concerns About Exclusions:

“I’m addressing [Client Name]’s concerns about policy exclusions. Can you assist me in explaining the [scope/impact] of [specific exclusions/limitations] to provide clarity?”

7. Reviewing Client Name’s Additional Riders:

“I want to review the additional riders [Client Name] added to their policy. Can you help me ensure they understand the [benefits/costs] of these riders and whether they still align with their needs?”

8. Highlighting Client Name’s Renewal Options:

“I’m preparing to discuss renewal options with [Client Name]. Could you guide me in outlining the [automatic renewal/alternative plans] and the [advantages/disadvantages] of each?”

9. Checking Client Name’s Beneficiary Designations:

“I need to review [Client Name]’s beneficiary designations. Can you help me ensure that their [beneficiary information/allocation percentages] are up-to-date and accurately reflect their wishes?”

10. Exploring Client Name’s Future Goals:

“I’m exploring [Client Name]’s future goals during the policy review. Could you provide guidance on how to assess their [retirement plans/estate planning goals] and suggest any adjustments?”

Note: Feel free to use these prompts and insert specific information in the placeholders provided. I’ll then provide you with comprehensive and detailed assistance for conducting thorough policy reviews for your clients.

12. Ongoing Support

1. Maintaining Client Name’s Policy Updates:

“I’m responsible for keeping [Client Name]’s policy up to date. Can you guide me on how to regularly review [coverage limits/endorsements] and ensure they remain appropriate?”

2. Assisting Client Name with Claims Processing:

“I want to offer [Client Name] assistance throughout the claims process. Could you provide step-by-step guidance on how to help them [initiate/file] a claim and follow up until [assessment/payout]?”

3. Addressing Client Name’s Policy Queries:

“I need to handle [Client Name]’s policy inquiries. Can you help me develop [clear explanations/relevant examples] for their questions about [coverage terms/limits]?”

4. Sending Client Name Renewal Reminders:

“I’m tasked with sending [Client Name] timely renewal reminders. Could you help me create [notification emails/alert messages] to ensure they renew their policy on time?”

5. Guiding Client Name Through Policy Updates:

“I’m assisting [Client Name] with policy updates. Can you help me outline the [necessary documents/procedures] to ensure they make [timely/accurate] updates to their policy?”

6. Checking In on Client Name’s Life Changes:

“I want to proactively check in with [Client Name] regarding significant life changes. Could you assist me in creating a [communication plan/life events checklist] to ensure their coverage remains relevant?”

7. Explaining Client Name’s Payment Inquiries:

“I need to provide explanations for [Client Name]’s payment-related questions. Can you guide me in offering [payment history clarification/explanation of charges] to address their concerns?”

8. Offering Client Name Annual Coverage Review:

“I’m planning an annual coverage review for [Client Name]. Could you help me schedule a [policy evaluation/meeting] to ensure their [coverage/limits] are still suitable?”

9. Providing Updated Policy Documents to Client Name:

“I want to ensure [Client Name] receives their updated policy documents. Can you guide me in delivering [revised policy document/endorsement details] that reflect recent changes?”

10. Assisting Client Name with Online Account Access:

“I’m helping [Client Name] navigate their online account for policy management. Could you provide [account setup instructions/password reset guidance] to enhance their online experience?”

Note: Feel free to use these prompts and insert specific information in the placeholders provided. I’ll then provide you with comprehensive and detailed assistance for offering ongoing support to your clients.

13. Renewals and Updates

1. Preparing Client Name’s Policy Renewal:

“I’m preparing for [Client Name]’s policy renewal. Can you guide me on the [steps/documents] required to initiate the renewal process and ensure their [coverage/limits] are up-to-date?”

2. Explaining Renewal Options to Client Name:

“I want to explain renewal options to [Client Name]. Could you help me outline the [automatic renewal/alternative plans] available and highlight the [benefits/adjustments] associated with each?”

3. Assisting Client Name with Policy Updates:

“I’m assisting [Client Name] in making updates to their policy. Can you provide guidance on how to [add/remove coverage/adjust policy limits] to better suit their current needs?”

4. Addressing Client Name’s Questions About Renewal Changes:

“I need to address [Client Name]’s questions about changes in their renewal terms. Can you assist me in providing [clear explanations/impact assessments] to ensure they understand the updates?”

5. Sending Client Name Renewal Reminders:

“I’m sending [Client Name] timely reminders for their policy renewal. Could you guide me on creating [notification emails/alert messages] to prompt them to renew their coverage?”

6. Explaining Client Name’s Renewal Premiums:

“I want to explain the renewal premiums to [Client Name]. Can you help me provide [clear breakdown/comparison with last year] of the premium changes and the factors affecting them?”

7. Guiding Client Name Through Policy Adjustments:

“I’m guiding [Client Name] through adjusting their policy before renewal. Could you assist me in explaining how [increasing coverage/revising deductibles] can benefit them?”

8. Discussing Client Name’s Claims History Impact on Renewal:

“I need to discuss how [Client Name]’s claims history might impact their renewal. Can you provide insights into how [previous claims/incidents] can influence their renewal terms?”

9. Offering Client Name Enhanced Coverage Options:

“I’m considering offering [Client Name] enhanced coverage options during renewal. Could you guide me on suggesting [additional riders/upgraded limits] to better protect their assets?”

10. Explaining Client Name’s Premium Payment Options:

“I want to explain premium payment options to [Client Name] during renewal. Can you assist me in outlining [annual/semi-annual/monthly] payment choices and their associated benefits?”

Note: Feel free to use these prompts and insert specific information in the placeholders provided. I’ll then provide you with comprehensive and detailed assistance for managing renewals and updates for your clients.

14. Claims Assistance

1. Guiding Client Name Through the Claims Process:

“I’m guiding [Client Name] through the claims process. Can you provide a step-by-step breakdown of how to [initiate/fill out] a claim form and the subsequent stages of [assessment/payout]?”

2. Explaining Client Name’s Coverage for the Claim:

“I need to explain [Client Name]’s coverage in relation to their claim. Can you guide me in clarifying the [policy terms/limits] and how they apply to the [incident/nature of the claim]?”

3. Assisting Client Name in Document Submission:

“I’m assisting [Client Name] with submitting claim documents. Could you provide guidance on gathering [required documentation/photos] to support their claim effectively?”

4. Addressing Client Name’s Questions About Claims Timing:

“I need to address [Client Name]’s questions about the timing of their claim processing. Can you assist me in explaining the [typical processing timeline/factors affecting speed] of claim settlements?”

5. Coordinating with Client Name and Adjusters:

“I’m coordinating between [Client Name] and the claims adjuster. Can you guide me on how to facilitate [communication/documentation sharing] to expedite the claim assessment?”

6. Reviewing Client Name’s Claim for Accuracy:

“I want to review [Client Name]’s claim before submission. Could you provide insights on how to [double-check/validate] the accuracy of their [claim details/supporting documents]?”

7. Explaining Client Name’s Role in the Claims Process:

“I need to explain [Client Name]’s role during the claims process. Can you help me outline their [responsibilities/responses] at various stages of the claim?”

8. Preparing Client Name for Adjuster Interaction:

“I’m preparing [Client Name] for interaction with the claims adjuster. Could you guide me in providing [communication tips/expectation setting] for a smooth claims assessment?”

9. Advising Client Name on Reimbursement Claims:

“I want to advise [Client Name] on reimbursement claims. Can you assist me in explaining the [proof of expenses/receipt submission process] to ensure they receive timely reimbursement?”

10. Managing Client Name’s Claims Follow-Up:

“I’m managing the follow-up on [Client Name]’s claim status. Could you help me draft [polite follow-up emails/call scripts] to obtain updates from the claims department?”

Note: Feel free to use these prompts and insert specific information in the placeholders provided. I’ll then provide you with comprehensive and detailed assistance for assisting clients through the claims process.

15. Client Relationship Management

1. Creating Client Name’s Personalized Insurance Profile:

“I’m creating a personalized insurance profile for [Client Name]. Can you guide me on [information gathering/client preferences] to tailor their coverage recommendations?”

2. Scheduling Regular Check-Ins with Client Name:

“I want to schedule regular check-ins with [Client Name]. Could you help me create a [communication plan/meeting schedule] to stay engaged and address their evolving needs?”

3. Sending Birthday and Anniversary Wishes to Client Name:

“I’m sending birthday and anniversary wishes to [Client Name]. Can you assist me in crafting [personalized messages/greeting cards] to strengthen our client-agent relationship?”

4. Tailoring Client Name’s Renewal Approach:

“I need to tailor the renewal approach for [Client Name]. Could you provide insights on [preferred communication channels/timing] to ensure a seamless renewal experience?”

5. Updating Client Name on Industry Trends:

“I want to keep [Client Name] updated on industry trends. Can you guide me on [compiling relevant articles/hosting webinars] to enhance their insurance knowledge?”

6. Collecting Feedback from Client Name on Services:

“I’m collecting feedback from [Client Name] on our services. Could you help me create [survey questions/feedback forms] to gauge their satisfaction and suggestions?”

7. Addressing Client Name’s Concerns Promptly:

“I need to address [Client Name]’s concerns promptly. Can you assist me in providing [timely responses/accurate solutions] to ensure their peace of mind?”

8. Offering Client Name Personalized Coverage Recommendations:

“I want to offer [Client Name] personalized coverage recommendations. Could you guide me on analyzing their [changing needs/life events] to suggest suitable adjustments?”

9. Discussing Client Name’s Long-Term Goals:

“I’m discussing [Client Name]’s long-term goals. Can you assist me in conducting a [comprehensive needs assessment/goal-setting session] to align their coverage accordingly?”

10. Arranging Client Name’s Annual Review Meeting:

“I’m arranging [Client Name]’s annual review meeting. Could you help me schedule a [policy evaluation/discussion] to ensure their coverage remains aligned with their needs?”

Note: Feel free to use these prompts and insert specific information in the placeholders provided. I’ll then provide you with comprehensive and detailed assistance for effectively managing client relationships.

Final Thoughts:

In the realm of insurance, where personalized interactions are paramount, ChatGPT Prompts emerge as a transformative asset. From crafting tailored proposals to simplifying claims processes, these prompts redefine agent-client interactions. By embracing this innovative tool, insurance agents can enhance their expertise, strengthen relationships, and navigate the industry landscape with confidence. Experience the evolution firsthand and propel your insurance journey toward success with ChatGPT Prompts for Insurance Agents.

1. How is ChatGPT used in the insurance industry?

ChatGPT can be used in the insurance industry for various purposes, including customer service, claims processing, and underwriting. It can assist in answering customer inquiries, providing information about insurance policies, and guiding customers through the claims process.

2. What questions should I ask an insurance agent?

When speaking with an insurance agent, you might want to ask about policy coverage, premium costs, deductibles, discounts, claims process, policy customization options, and any specific details related to the type of insurance you’re interested in (auto, health, home, etc.).

3. How to introduce yourself as an insurance agent on social media?

When introducing yourself as an insurance agent on social media, you could start with a friendly greeting, mention your name and role, highlight your expertise in the insurance field, and express your commitment to helping clients find the right coverage. You can also share some personal interests to add a relatable touch.

4. How do I advertise myself as an insurance agent?

To advertise yourself as an insurance agent, you can create a professional website, maintain active social media profiles, share informative content about insurance, highlight your expertise, showcase client testimonials, and engage with potential clients through online communities and networking events.

5. What valuation method is used for insurance?

Insurance companies typically use a combination of valuation methods, including the Replacement Cost Method (estimating the cost to replace the insured item with a new one), the Actual Cash Value Method (taking depreciation into account), and the Agreed Value Method (pre-agreed value for unique items like art or jewelry).

6. Will AI replace insurance agents?

While AI can automate certain tasks within the insurance industry, such as processing claims and providing information, it’s less likely to completely replace insurance agents. Human agents offer personalized advice, empathy, and complex decision-making that AI may struggle with. AI is more likely to enhance the capabilities of agents rather than replace them entirely.

7. How is generative AI used in insurance?

Generative AI can be used in insurance for tasks like generating personalized insurance policy recommendations, drafting customer correspondence, creating marketing content, and even simulating various scenarios for risk assessment and planning.

8. What is an example of generative AI in insurance?

An example of generative AI in insurance could be using AI to generate personalized insurance policy proposals based on a customer’s individual needs and risk profile. The AI could analyze various factors and generate a tailored policy recommendation that suits the customer’s requirements.

9. How does ChatGPT affect the insurance industry?

ChatGPT can improve customer service in the insurance industry by providing quick and accurate responses to customer inquiries. It can also assist in automating routine tasks, freeing up human agents to focus on more complex and personalized interactions.

10. What risk management methods do insurance companies use?

Insurance companies use various risk management methods, including risk assessment, risk mitigation strategies, diversification of portfolios, reinsurance (insuring the insurance company itself), and data analytics to identify and manage potential risks.